Esker’s document process automation (DPA) software helps customers move from paper-based to digital document processing. Its well- established SaaS solution has attracted a large number of customers, with transaction-based revenues making up a growing proportion of revenues. We expect growth in the on-demand business to outweigh declines in the legacy and traditional on-premise businesses. Share price upside will depend on the rate of adoption of the on-demand solution.

Document Process Automation Specialist

Esker’s main business is the development and sale of DPA software and services. Its solutions enable companies to automate accounts payable, accounts receivable, sales order processing and document delivery processes. Benefits include reducing paper-related costs and errors in processing, speeding up the cash conversion cycle, improving process visibility within the enterprise and improving customer service. Its declining legacy business sells fax servers and terminal emulators. Revenues are generated in Europe and the US, with minimal exposure to Asia, and the company is targeting sales expansion in South America and Canada.

SaaS Solutions Driving Growth

Esker offers its DPA solutions as on-premise and on-demand products, designed as end-to-end solutions. Esker has the advantage of being a long way through the transition from on-premise to SaaS software delivery, with all the relevant technology development complete and a large number of customers already using the on-demand service. The on-demand version has seen the strongest growth over recent years with per-transaction revenues growing from 33% of revenues in FY09 to 48% in FY12. We expect this to fuel growth in FY13-14 (up to 55% of revenues) and to drive growth in recurring revenues (traffic and maintenance fees), which already made up 71% of FY12 revenues and close to 75% in Q113.

Financials And Valuation: On-Demand Adoption Is Key

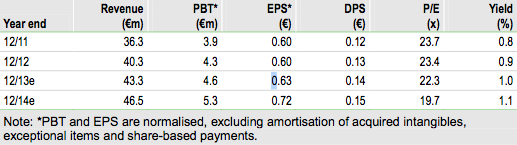

We expect on-demand DPA revenue growth to outweigh the decline in on-premise licences and legacy products. Esker trades on a P/E multiple of 22.3x FY13e and 19.7x FY14e EPS, at a similar level to global DPA peers in FY13 and at a premium to French small-cap software peers. Esker has a very high level of recurring revenues, and after this year should be able to grow revenues faster than the cost base and expand margins. Esker pays a small dividend, with a yield of 1% for FY13 and FY14, and has a strong cash position that should enable it to fund bolt-on acquisitions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

An Inside Look At Esker

Automating Document Processing

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.