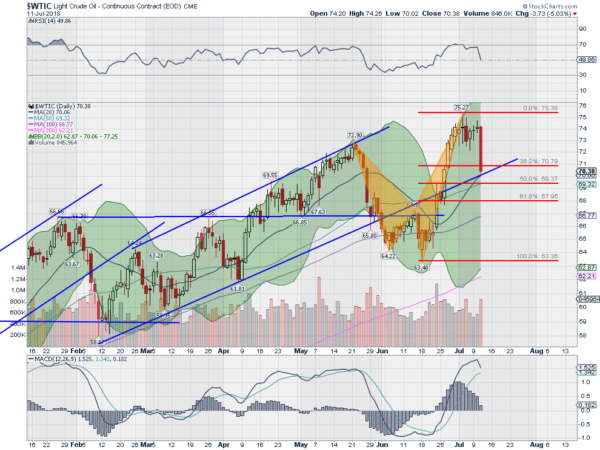

Crude Oil has been on a tear lately. The price moved up to 20 month highs last week and stabilized there. Wednesday saw a collapse though. Falling more that 5%, the sellers were piling on. Is this the beginning of a major pullback? Or is this an opportunity to get in cheap before it gushes higher? The chart below may tell the story.

Several aspects of this chart point to an opportunity. First there is the stall point on the drop. This is right at the rising 20 day SMA, hardly a bearish price level. It is still far above the rising 200 day SMA. Next there is the rising trend support. This had been in place since the February low. It was breached to the downside in June but had recovered. The bottom Wednesday coincided with a stop at this trend line.

The top last week completed a bearish Shark harmonic pattern as well. And with the drop Wednesday, it had retraced 38.2% of the pattern, the first target and a healthy place to reverse. In the pre-market trading Thursday Crude Oil is stabilizing. It may yet start a second leg lower. But this price level would be a goo place to see a reversal. A long position against a stop at Wednesday’s low offers a good reward to risk trade off.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.