- U.S. data mixed after two quarters of negative growth

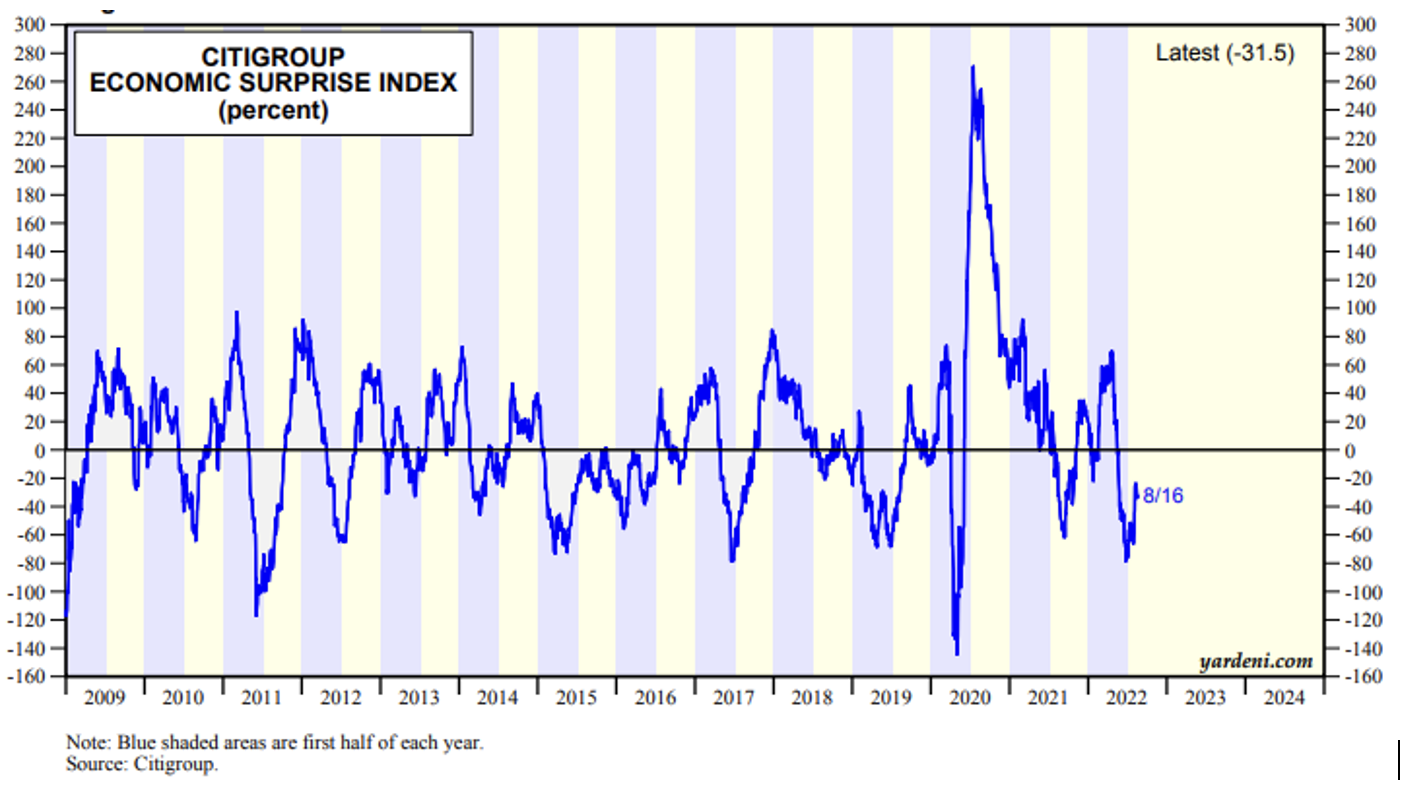

- Citi Economic Surprise Index is below zero

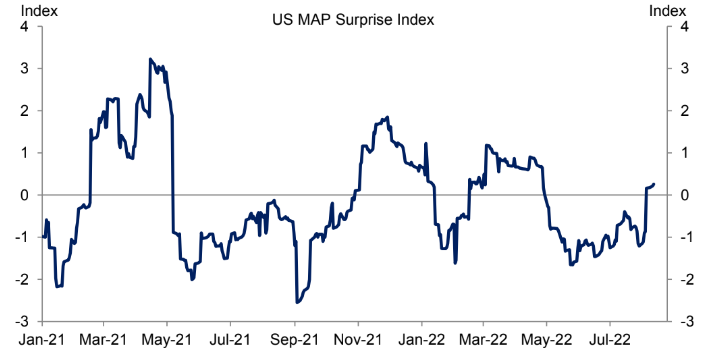

- But Goldman Sachs reports recent data has been better than expected

- Fed closely monitoring ahead of Jackson Hole and September FOMC gathering

Recent gauges on the strength and stability of the domestic economy have been cloudy. There have been strong data points, like the July nonfarm payrolls report, but also grim signs from regional economic reports and the housing market. It’s all about expectations, though. I like to keep tabs on how data verify versus consensus estimates.

The Citigroup Economic Surprise Index (CESI) is creeping closer to the unchanged line. The gauge of the economic data’s strength relative to economists’ expectations was sharply negative just a few weeks ago. Not surprisingly, at the halfway mark of 2022, the CESI was at its lowest reading since the early stages of the post-COVID-crash rally. Thanks to healthy jobs data and a cooler-then-expected CPI report earlier this month, recession fears have eased. You can dig into all the key tidbits of economic conditions on the St. Louis Federal Reserve’s revamped FRED macro snapshot.

Source: Yardeni Research

I also like to monitor what is happening with Goldman Sachs Investment Research’s U.S. MAP index, which is comparable to the CESI. What’s great about Goldman’s report is that it measures economic surprises at home compared with those around the world. Earlier this week, it turned positive. There are certainly signs that the economy is hanging in there despite that dire second-quarter GDP report released in July that confirmed two consecutive quarters of contraction. It will be interesting to see how much GDP numbers are adjusted in the inevitable revisions. After all, the COVID economy upended just about all areas of the financial markets—including the four big GDP components.

Source: Goldman Sachs Investment Research

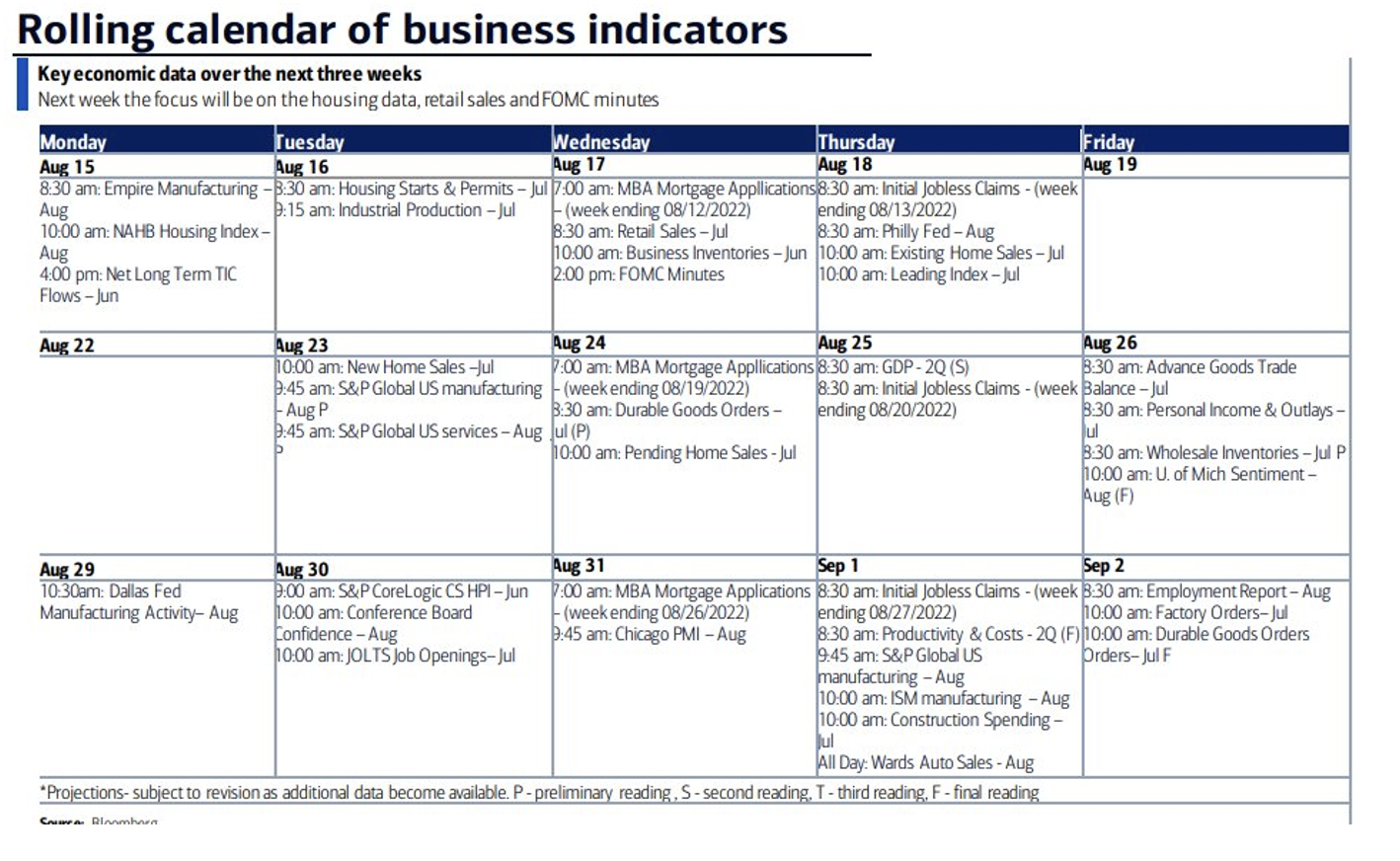

Along with jobs, inflation, and GDP, the ISM Manufacturing number, which comes out on the first business day of the month, is well off its high above 63 notched way back in March 2021 (about the period when the last of the stimulus checks hit Americans’ bank accounts). At just 52.8, the economic barometer is dangerously close to a sub-50 contraction reading. After the August 25-27 Jackson Hole Economic Symposium, that will be the big data point to track. The August nonfarm payrolls report then crosses the wires on September 2.

Source: BofA Global Research

So between now and then, the market will have a moment to catch its breath after a tremendous summer rally. U.S. stocks retraced more than half the January-through-June-16 drop as data and earnings verified better than forecasted. Moreover, the bond market has found its footing, with the ICE BofAML MOVE, which measures interest-rate volatility, having eased, allowing the Treasury market to stabilize. More certainty on the future cost of money provides reassurance to the corporate world, albeit at more expensive rates than a year ago. We’ve seen confidence build in the fixed-income market by way of corporate credit spreads, too. The rate-premium on high-yield bonds has nearly drifted to the lowest levels in three-and-a-half months.

Bottom Line

The economy is sending us mixed signals. The upshot is that key data points are coming in a bit better than expectations compared to a month or two ago. The Fed is sure to be keeping a close eye on how growth and inflation readings come in before the next meeting, which is still five weeks away.

Disclaimer: Mike Zaccardi does not hold any positions in the securities mentioned in this article.