Are we tiring of the fiscal cliff story? Is it becoming cliche to state the obvious… that uncertainty over the resolution of expiring tax breaks and potential spending cuts is adversely affecting the stock market?

Perhaps. Yet one avenue that hasn’t received as much digital ink is the possibility that “yield” is turning into a dirty word. (It may have five letters, but yield-oriented assets have been performing like four-letter losers!)

Consider what we might typically expect when economic growth is weak; that is, sub-par expansion usually favors income producers. Dividend stocks, utility stocks, master limited partnerships, REITs — each tends to rely less on economic cycles and more on reliable income streams.

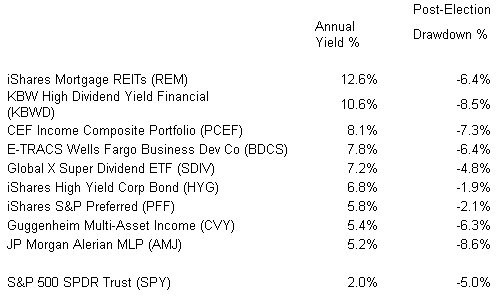

However, the current uncertainty surrounding future tax policy is wreaking havoc on income producers. Many have been hit every bit as hard as the broader S&P 500 SPDR Trust (SPY).

High-Yielding ETFs Since Post-Election Selling Spree (11/7-11/15)

Theoretically, of course, the vast majority of assets in the table should have a built-in buffer against downside erosion. The distribution component on yield-oriented ETFs should offset excessive capital depreciation.

On the other hand, the market has presented a different theoretical construct. Specifically, if dividend tax hikes have the potential to be worse than capital gains hikes… can you still afford to hold onto the cash flow generators?

From my vantage point, no asset should be deemed “riskless.” One still needs to employ hedges or stop-limit loss orders to manage all of the ETF asset types, including yield-oriented ETFs.

By the same token, an investor should not wait for calm waters to participate. If you have cash that you’ve been waiting to put to work, and if you do not currently own assets like JP Morgan Alerian (AMJ) or E-Tracs Wells Fargo Business Development Company ETN (BDCS), now might be the perfect time to “get your yield on.” Just make certain that you have an exit plan.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

An Assault On Yield-Oriented ETFs

Published 11/17/2012, 02:25 AM

An Assault On Yield-Oriented ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.