In writing any market analysis, I am always conscious of two things. First, it is very easy to forget that the associated buying and selling in any market embraces the full spectrum, from long term investor, to the short term speculator. Secondly, and perhaps more significantly with gold, the focus often has a bullish bias, with the emphasis on the gold bugs rather than the gold bears. So, let me try to provide a more balanced analysis, which I hope will have something for everyone!

Starting with the investment perspective, those holding gold for the longer term have had a torrid time over the last two years. As always, once a market hits the mainstream media, then you can be fairly certain, that the market in question has probably reached a peak, and this was certainly the case with the precious metal. Almost two years ago every news channel and newspaper was highlighting gold as ‘the’ investment of the century as it approached the $2,000 per ounce region. Gold prices were going to the moon and beyond with many investors buying, fearing they would miss out on the opportunity to make some spectacular returns.

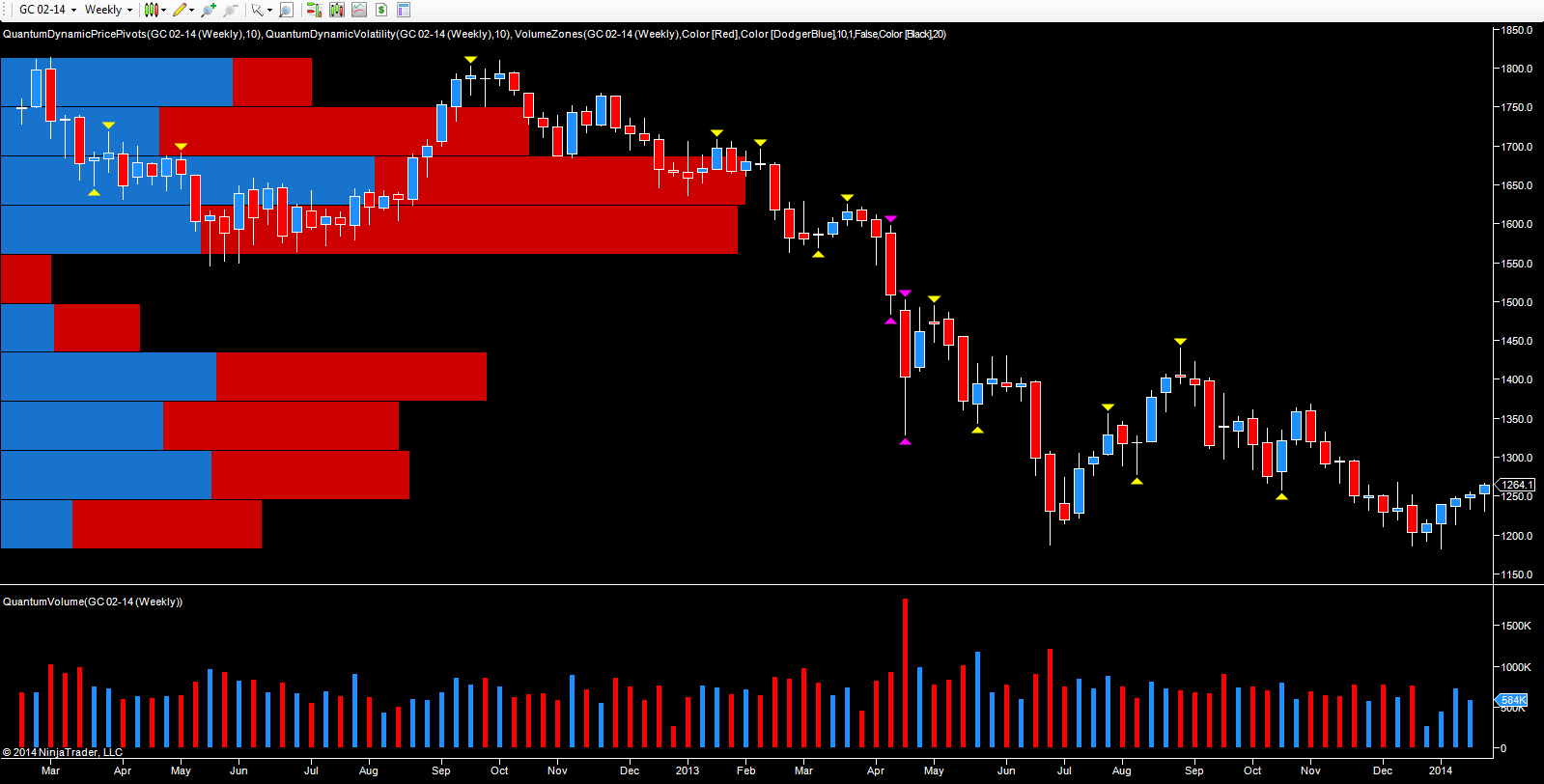

As we all know gold duly topped out on ultra high volume, falling almost $800 per ounce by the end of 2013. A painful experience for many who were caught at this top, and it is interesting to note that many commentators are now suggesting that the bottom in gold has been reached. However, whilst I am a gold bug at heart, I do not subscribe to this view, and the reason is very simple – there is no volume to suggest that we have yet witnessed a true reversal in sentiment, and one only has to look at the volumes associated with the selling climax of August and September 2011 for evidence of this simple fact.

Longer term investing is, of course, based on longer term timeframes, and the ideal charts here are the weekly and the monthly, and in neither case is there any evidence yet of stopping volume on a sustained basis. When the buyers return in strength, then this will be revealed in the associated volume and price action. The recent rally in gold has been welcome, but we have seen these before, and the only difference here, is that the metal now appears to be building a platform of support in the $1180 per ounce area which has now been tested on three separate occasions. This is the first time in the recent longer term decline, that we have finally seen a potential floor of support being built, so a glimmer of hope for long term investors. But the key remains volume, which is sorely lacking at present.

For speculative traders however, the opportunities have been many and varied. For longer term traders, shorting gold has been extremely profitable, with each new rally higher presenting further trading opportunities, with each pivot high sending its own clear signal of potential weakness. Whilst short selling has held sway, bullish traders have also had many opportunities, and indeed the start of 2014 has yielded some nice trading opportunities, as the metal has rallied once again from the low of $1180 to trade at $1264.30 at the time of writing.

Today’s rally was a classic example of the contradictions for gold traders and investors. For speculative bulls, a great day’s trading with the metal moving firmly above short term resistance in the $1260 per ounce level. For gold bears, it has been a game of patience, waiting for the latest rally to peter out like all the others, whilst for long term investors, it’s back to the burning question – has gold finally turned the corner, and is now on the way back?

From a technical perspective, I believe the answer remains – no. The short term rally since the start of the year is just that, and one only has to consider the volumes on the weekly chart. Here we see a fragile market rising on average and below average volumes, and with deep price congestion now ahead any sustained move higher, will need rising demand which is lacking at present. This may change in the coming weeks, but until it does, gold remains a market for the intra day and longer term speculative trader.

From a fundamental perspective longer term gold investors can take some comfort from the release of the much respected Thomson Reuters GFMS Gold Survey which has reported that China has overtaken India as the world’s largest buyer of gold with demand driven by jewellery and physical purchases of gold coins and bars. Demand last year reached almost 1200 tonnes with much being purchased by Chinese investors during gold’s recent sharp decline. This decline included the 880 tonnes shed by gold backed ETFs in 2013. Chinese demand has also seen a five hold increase since 2003. However, whilst this data is encouraging, in the medium to longer term any significant slowdown in the Chinese economy may curb this demand.