On Jun 17, Intuit Inc. (NASDAQ:INTU) was upgraded to a Zacks Rank #1 (Strong Buy).

Why the Upgrade?

Earnings estimates for Intuit are on the rise driven by stellar third-quarter fiscal 2017 results reported on May 23 and an upbeat guidance for fiscal 2017. The company reported adjusted income (including stock-based compensation but excluding amortization and other one-time items) from continuing operations of $3.71 per share, surpassing the Zacks Consensus Estimate of $3.67.

The company posted revenues of $2.541 billion, which came within management’s guided range of $2.50–$2.55 billion, outpacing the Zacks Consensus Estimate of $2.486 billion. On a year-over-year basis, revenues were up 10.3% owing to higher demand emanating from the U.S. tax season and better-than-expected growth in QuickBooks Online.

Intuit raised fiscal 2017 guidance and issued encouraging projections for the fourth quarter. The company now anticipates revenues of $5.13 billion to $5.15 billion in fiscal 2017, up 9% to 10% year over year (previously $5 billion to $5.1 billion).

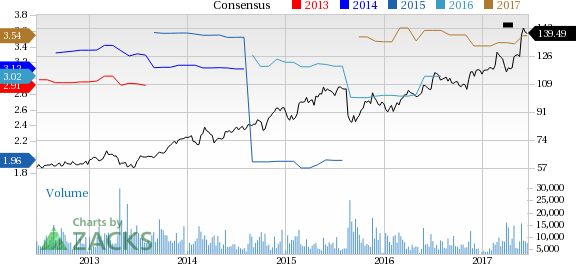

Upward Estimate Revision

Analysts have become increasingly bullish on the stock in the past 30 days with estimates moving upward. The Zacks Consensus Estimate for the fourth quarter is pegged at a loss of 6 cents, which shows an improvement of 2 cents from a loss of 8 cents projected 30 days ago. For fiscal 2017, earnings estimates moved upward to $3.54 per share from $3.44 projected 30 days ago.

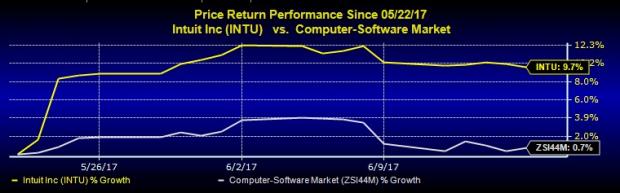

Share Price Movement

Intuit’s share price movement has been very impressive following the strong third-quarter fiscal 2017 results and upbeat guidance. In the last one month, its shares have gained 9.7% compared with the Zacks categorized Computer-Software industry’s meager increase of 0.7%.

Other Factors Driving the Stock

Intuit provides financial, accounting and tax preparation as well as software and related services for small businesses, consumers, and accounting professionals in the U.S. and internationally.

The business and financial software space in which Intuit operates has huge growth opportunity. There are over 29 million small and medium businesses in the U.S. alone. The company had over 2.22 million QuickBooks online subscribers in the country at the end of third-quarter fiscal 2017. We believe that Intuit’s growing SMB exposure will boost the segment and drive long-term growth. Notably, Intuit has raised expectations to end fiscal 2017 with 2.3 million QuickBooks Online subscribers.

Furthermore, Intuit is refreshing product line, in a move to shift its business model from selling desktop software to cloud-based subscription providers. With emerging technology and market trends, cloud-based solutions, as against software-based ones, have gained momentum in recent years. Hence, we are positive about Intuit’s increased adoption of its cloud-based services and products.

Other Stocks to Consider

Other top-ranked stocks in this industry include Verint Systems Inc. (NASDAQ:VRNT) , DST Systems, Inc. (NYSE:DST) and Exa Corporation (NASDAQ:EXA) . Verint Systems sports a Zacks Rank #1, while DST Systems and Exa carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Verint Systems has delivered an average positive earnings surprise of 36.69% in the trailing four quarters while DST Systems and Exa have delivered positive earnings surprises of 10.49% and 91.66%, respectively in the same time frame.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.See the pot trades we're targeting>>

DST Systems, Inc. (DST): Free Stock Analysis Report

Intuit Inc. (INTU): Free Stock Analysis Report

Exa Corporation (EXA): Free Stock Analysis Report

Verint Systems Inc. (VRNT): Free Stock Analysis Report

Original post

Zacks Investment Research