Amur (AMC.L) has raised £5.2m by way of a subscription by new and existing shareholders for a total of 71.7m shares (17% of shares in issue) at 7.25p (a 6.5% discount to the previous close). Of this, £5.0m follows the pattern of previous equity swap agreements with Lanstead Partners, which have proved successful in continuing to fund Amur’s exploration of its growing Kun-Manie nickel resource while it progresses its mining licence to approval with the Russian authorities. As a result of a modified structure to this agreement, a £1m up-front payment is to be paid to Amur, which will comfortably fund at least its current Kubuk drill programme.

Lanstead agreements should support Amur’s plans

We assume Amur spends US$1.5m on exploration in FY13. Management has stated that its drilling cost is c US$40/m, due to its drill rig being owner-operated. Hence the cost of its newly expanded 5,000m Kubuk drill campaign would be c US$200,000. Amur drilled a total of 7,200m across the whole of Kun-Manie in FY12 and we expect it to drill a comparable total meterage in FY13, resulting in a potential FY13 drilling cost of only US$288,000. With a £1m upfront payment to be made to Amur, we consider this sufficient funding to complete at least its Kubuk drill programme. The remaining £4m (US$6.1m) of the agreement could potentially pay out £167,000 (US$255,000) per month (subject to Amur’s share price maintaining the benchmark price of 9.67p). Even if it only achieves a proportion of that monthly funding, this Lanstead agreement should provide Amur with the ability to update its resource and reserve statements, the Kun-Manie economic model and its mine schedule to reflect higher grade areas identified since the 2007 PFS.

Updated resources and reserves to follow SRK visit

SRK Consulting is due to visit Kun-Manie shortly to verify Amur’s exploration procedures. Once completed SRK should be able to sign-off on its resource and reserve estimates, allowing Amur to shortly announce these to the market.

Valuation: Unchanged, forecasts reflect FY12 results

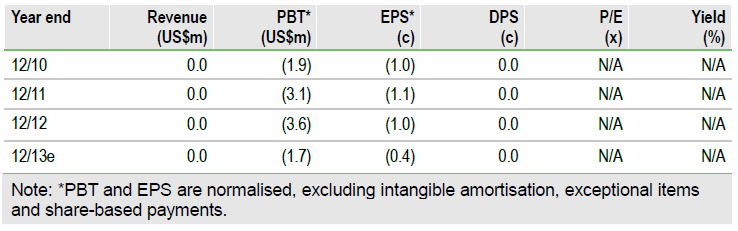

We have updated our forecasts for FY12 financial results. Amur reported a loss of US$3.6m, resulting predominantly from G&A costs of US$1.8m and a US$1.8m finance expense charge relating to its pre-existing Lanstead agreement. We reiterate our previous estimate of this project’s value of US$394m equating to 60p per share (accounting for the additional shares, and using a US$20,000/t Ni price and 10% discount rate). This was primarily based on the old 2007 SRK Consulting pre-feasibility study, which will now be revised in light of the new exploration results.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Amur Minerals: New Funding Should Support Company Plans

Funding secured

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.