Credit rating giant, A.M. Best recently affirmed the issuer credit rating (ICR) of “bbb” of AmTrust Financial Services, Inc. (NASDAQ:AFSI) . Concurrently, the rating agency reiterated the financial strength rating of A (Excellent) and ICR of “a” of the property/casualty subsidiaries of AmTrust Financial. The outlook for ratings remained stable.

The rating affirmation came on the back of AmTrust Financial’s strong balance sheet, solid underwriting and operating performance in the niche market segments. Also, the rating accounts for the support provided by AmTrust to its subsidiaries.

AmTrust Financial has successfully executed its business plan to improve through strategic buyouts and renewal of rights offerings. The business plan also prioritizes on the expansion of the established books of business at appropriate rates, terms and conditions. As a result, AmTrust Financial will be able to further leverage its scalable underwriting platform to lower expenses.

However, the positives were partially offset by the continued substantial premium volume growth and related liabilities over the current five-year period. Policy renewal rights transactions and acquisitions as well as organic growth owing to rate increases and new policies, are responsible for this. The acquisitions expose the company to risks associated with expansion into new markets and combination of new businesses.

Nonetheless, the company’s leverage ratios as well as interest coverage were within A.M. Best’s guidelines.

The rating agency might upgrade the ratings if the company can sustainably outperform its peers and maintain risk-adjusted capitalization.

The rating agency might take negative action if there is a change in the financial performance or deterioration in risk-adjusted capitalization due to an event, emergence of adverse development of loss reserves or other factors. Also, a change in the financial condition of AmTrust Financial might result in the ratings being downgraded.

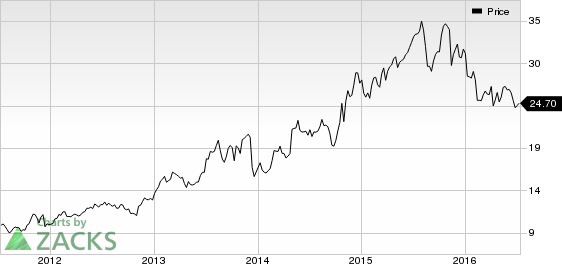

Rating affirmations or upgrades from credit rating agencies play an important role in retaining investor confidence on the stock as well as maintaining credit worthiness in the market. Hence, it is expected that such ratings will help the company instill and retain investor confidence in the future.

Zacks Rank and Stocks to Consider

Currently, AmTrust Financial carries a Zacks Rank #4 (Sell). Some of the better-ranked stocks are MS&AD Insurance Group Holdings, Inc. (OTC:MSADY) , Third Point Reinsurance Ltd. (NYSE:TPRE) and ProAssurance Corporation (NYSE:PRA) . While both MS&AD Insurance and Third Point Reinsurance sport a Zacks Rank #1 (Strong Buy), ProAssurance holds a Zacks Rank #2 (Buy).

PROASSURANCE CP (PRA): Free Stock Analysis Report

AMTRUST FIN SVC (AFSI): Free Stock Analysis Report

THIRD PT REINSR (TPRE): Free Stock Analysis Report

MS&AD INSURANCE (MSADY): Free Stock Analysis Report

Original post

Zacks Investment Research