The selloff in global markets continue in Asia today with Nikkei down -2.5% at the time of writing. Hong Kong HSI is losing -2.3% while Singapore Straits Times loses -1.3%. Korea's KOSPI also drops -1.4%. Yen extends recent broad based rally against other major currencies on risk aversion trades. Nonetheless, the gain is so far limited as major yen crosses quickly recovered back into Friday's range. Elsewhere, dollar is steady against Europeans and commodity currencies as most pairs are bounded in tight range. Gold extends recent recovery on safe haven demand.

The selloff in emerging market currencies spilled over to other financial markets last week. Some attributed the panic selling to fear on China's slowdown. But it should be noted that emerging market currencies like Turkish Lira and Argentinian Peso have been under pressure for some time already. The current selloff in markets are more likely a result of a number of issues coming at the same time. And that would also include political turmoils in some countries like Ukraine. Of course, on the backdrop, it's worries on Fed's tapering as well as China slowdown.

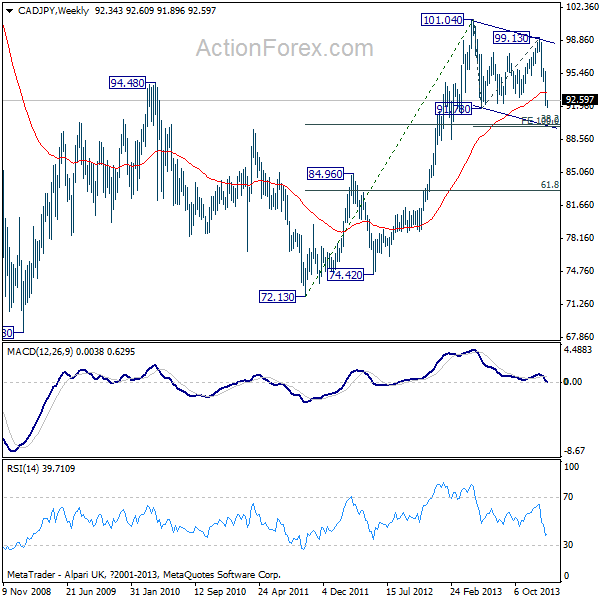

Among the yen crosses, the CAD/JPY is the weakest this month so far. The development in CAD/JPY suggests that fall from 99.13 is resuming the whole decline from 101.04. and would likely take out key support level at 91.78. Nonetheless, a look at the weekly chart argues that such decline from 101.04 might only be a correction pattern. And it's probably the fourth wave of a five wave sequence fro 72.13 (2011 low). Thus, we might start to see diminishing downside momentum after passing through 91.78. And there would be strong support at next cluster level at around 90 (38.2% retracement of 72.13 to 101.04 at 89.99, 100% projection of 101.04 to 91.78 from 99.13 at 89.87).

CAD/JPY Weekly Chart" title="CAD/JPY Weekly Chart" width="474" height="242" />

CAD/JPY Weekly Chart" title="CAD/JPY Weekly Chart" width="474" height="242" />

On the data front, Japan trade deficit came in narrower than expected at JPY -1.15T in December. German Ifo is the main focus in European session. The business climate, current assessment and expectations gauges are all expected to show improvements in January. US will release new home sales.