Amgen (NASDAQ:AMGN) and partner Allergan (NYSE:AGN) announced that the FDA approved their biosimilar version of Roche’s (OTC:RHHBY) cancer drug, Avastin (bevacizumab), for treatment of five types of cancers including lung cancer, colorectal cancer, glioblastoma, renal cell carcinoma and cervix cancer. The biosimilar will be marketed by the trade name Mvasi.

Mvasi is the first cancer biosimilar approved in the United States. It is also the first bevacizumab biosimilar in the country. Notably, Amgen has also submitted regulatory applications for the same in the EU.

We remind investors that in July, the FDA’s Oncologic Drugs Advisory Committee had unanimously voted to recommend approval of Mvasi.

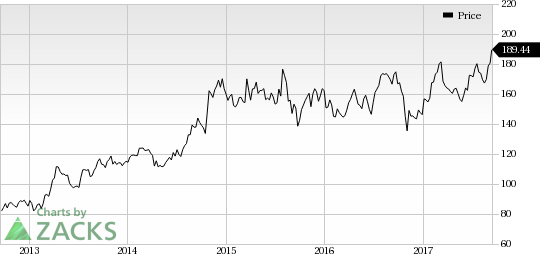

Amgen’s shares have outperformed the industry so far this year. The stock has plunged 29.6% versus the broader industry’s 15.4% rally.

The approval was supported by a comprehensive data package that demonstrated similarity of Mvasi with bevacizumab. Data also included results from a phase III comparative efficacy, safety and immunogenicity study, confirming no clinically meaningful difference between Mvasi and the reference product.

Amgen and Allergan are also developing biosimilar versions of Roche’s Herceptin (ABP 980 — under review in the United States and the EU) and Rituxan (ABP 798 in phase III).

Amgen’s biosimilar version of AbbVie’s Humira Amjevita, was approved by the FDA in September last year. However, Amjevita has not been launched yet due to an ongoing litigation. Others under development include Amgen’s biosimilar versions of Alexion’s Soliris, Lilly’s Erbitux and Johnson and Johnson (NYSE:JNJ) /Merck’s Remicade. Interestingly, biosimilar endeavors offer a lucrative opportunity of annual revenues worth $3 billion above for Amgen. The company has also collaborated with Japan’s Daiichi Sankyo for commercialization of nine biosimilars in Japan.

With accelerating approvals of biosimilars, a number of pharmaceutical and biotech companies are working on to bringing biosimilars in the market. Though many biosimilars are marketed in the EU, very few are available in the United States. Last November, Pfizer (NYSE:PFE) had launched Inflectra, a biosimilar version of Remicade. Sandoz also markets Zarxio, the first biosimilar to be approved in the United States. The product is in turn a biosimilar of Amgen’s Neupogen. In July 2016, Merck (NYSE:MRK) had launched Reneflexis, a biosimilar version of Remicade in the United States.

In August last year, Sandoz had gained an FDA approval for Erelzi, a biosimilar version of Amgen’s Enbrel. However, the product is on hold due to ongoing litigation and is yet to be unveiled in the United States.

Zacks Rank

Amgen currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Allergan PLC. (AGN): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Original post

Zacks Investment Research