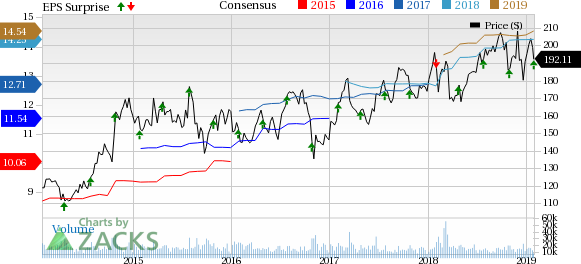

Amgen Inc. (NASDAQ:AMGN) reported fourth-quarter 2018 earnings of $3.42 per share, which beat the Zacks Consensus Estimate of $3.26. Earnings increased 18% year over year driven by higher revenues, lower tax rate and reduced share count.

Total revenues of $6.23 billion in the quarter surpassed the Zacks Consensus Estimate of $5.88 billion and increased 7% year over year.

Quarter in Detail

Total product revenues increased 8% from the year-ago quarter to $6.0 billion (U.S.: $4.66 billion; ex-U.S.: $1.35 billion) as increasing demand for newer products like Prolia, Repatha Kyprolis, Xgeva and Blincyto was partially offset by lower sales of mature brands like Enbrel, Aranesp, Epogen, Neulasta and Neupogen due to competitive pressure. Other revenues of $229 million declined.7% in the quarter.

While volumes growth added 10% to the top line, foreign exchange had a negative 1% impact on sales.

Prolia revenues came in at $655 million, up 14% from the year-ago quarter, attributable to 12% volume growth resulting from higher demand and share gains in both the United States and international markets.

Xgeva delivered revenues of $456 million, up 17% from the year-ago quarter mainly due to higher demand, which drove volumes. In 2018, Xgeva gained approval in both United States and EU for the prevention of skeletal-related events in patients with multiple myeloma. The approval for the expanded patient population led to higher volumes of Xgeva in 2018.

Vectibix revenues came in at $168 million, up 6%, driven by higher demand.

Kyprolis recorded sales of $251 million, up 11% year over year, driven primarily by robust uptake in outside U.S. markets.

Blincyto sales increased 37% from the year-ago period to $63 million, reflecting rise in demand.

Amgen’s PCSK9 inhibitor, Repatha, generated revenues of $159 million, up 62% year over year as higher unit demand was offset by lower prices. Sales of Repatha have suffered since launch due to payer restrictions. Despite Amgen’s efforts to improve access to Repatha, patients face significant hurdles due to high co-pay expenses. In response, Amgen announced the decision to cut the U.S. list price of Repatha by 60% to improve access and affordability of Repatha. Though lower price may impact Repatha sales in the near term, management is optimistic about better volume growth in the long term.

Parsabiv, launched in several markets including United States in the first quarter, recorded sales of $120 million in the fourth quarter, much higher than $102 million in the previous quarter.

Amgen’s newly launched CGRP inhibitor for migraine prevention, Aimovig (erenumab) recorded sales of $95 million in the quarter compared with $22 million in the previous quarter. On the call, the company said that Aimovig’s launch has been strong and it reached more than 150,000 patients in 2018.

Interestingly, Amgen recorded biosimilar revenues of $55 million in the quarter, entirely from international markets. In several European countries, Amgen launched Amjevita, its biosimilar version of AbbVie’s blockbuster rheumatoid arthritis drug, Humira in October and Kanjinti, biosimilar of Roche’s cancer drug Herceptin, in May.

However, Amgen’s mature drugs like Enbrel, Aranesp, Epogen, Neupogen and Neulasta are facing an array of branded and generic competitors.

Revenues of Amgen’s erythropoiesis-stimulating agent (ESA), Aranesp declined 3% from the prior-year quarter to $474 million on lower demand primarily due to increased competitive pressure, unfavorable changes in inventory levels and lower pricing.

Revenues of the other ESA, Epogen, declined 2% to $264 million due to lower selling prices as the category has become extremely competitive. Pfizer’s (NYSE:PFE) Retacrit, the first biosimilar version of Epogen, was launched in November 2018. Biosimilar competition coupled with Amgen’s contractual pricing commitments with DaVita, Inc. is expected to hurt Epogen’s price significantly in 2019

Neulasta revenues rose 5% to $1.17 billion from the year-ago period as a U.S. government order led to higher volumes in the quarter, which offset the impact of lower selling prices due to biosimilar competition in the United States. Two companies, Mylan (NASDAQ:MYL) and Coherus have launched biosimilars of Neulasta in the United States in the recent past while numerous biosimilars are marketed in Europe, which is hurting sales. More biosimilars are expected to be launched in 2019, which will put further pressure on Neulasta sales.

Neupogen recorded 40% decline in sales to $75 million due to biosimilar competition in the United States, which hurt demand and prices.

Enbrel delivered revenues of $1.32 billion, down 8% from the year-ago quarter due to lower prices and increased competition, which hurt demand.

Sensipar/Mimpara revenues rose 8% to $448 million as favorable changes in accounting estimates and higher pricing offset lower demand trends. Demand trends for Sensipar are being hurt by Parsabiv launch, which is also marketed for secondary hyperparathyroidism. Sensipar also lost patent exclusivity in March 2018 and Teva (NYSE:TEVA) launched its generic version (at-risk) in late 2018. However, Amgen and Teva settled their ongoing dispute earlier this month and Teva will no longer sell its generic product until its license date in mid-year 2021. However, other generic drugmakers may launch a generic version (at-risk) anytime.

Other product sales rose 6% to $73 million.

Operating Margins Decrease

Adjusted operating margin declined 60 basis points (bps) to 45.3% due to higher operating costs.

SG&A spend increased 9% to $1.53 billion on higher investments to support new products as well as already marketed products. R&D expenses rose 13% year over year to $1.16 billion.

Adjusted tax rate was 13% for the quarter, a 3.3 points decrease from the fourth quarter of 2017.

Amgen repurchased 11.1 million shares worth $2.2 billion in the fourth quarter and has $5.1 billion remaining under its stock repurchase authorization.

2018 Results

Full-year 2018 sales rose 4% to $23.75 billion, beating the Zacks Consensus Estimate of $23.37 billion. Revenues were slightly above the guided range of $23.2-$23.5 billion. Product sales rose 3% in the quarter.

Adjusted earnings for 2018 were $14.40 per share, which beat the Zacks Consensus Estimate of $14.14 and rose 14% year over year. Earnings were above the guided range of $14.00-$14.25 per share.

2019 Guidance

Amgen issued its sales and earnings guidance for 2019, which indicates a decline from 2018 levels. The company expects revenues in the range of $21.8-$22.9 billion, indicating a decline from 2018 levels. The Zacks Consensus Estimate is currently at $22.87 billion.

Adjusted earnings per share are anticipated in the range of $13.10-$14.30 in 2019, lower than the current Zacks Consensus Estimate of $14.45. The guided range indicates a decline from 2018.

Our Take

Amgen beat estimates for fourth-quarter earnings as well as sales. However, shares of Amgen fell around 2.4% in after-hours trading on Tuesday as the 2019 forecast disappointed investors - a trend seen at several other large drugmakers this quarter. In the past year, Amgen’s stock has risen 0.4% against 23.6% decrease of its industry.

While Amgen’s newer drugs – Prolia, Xgeva, Blincyto, Kyprolis – will drive sales, generic competition to Sensipar, continued competitive dynamics for Enbrel and new competition against Aranesp and Neulasta will create pressure on the top line in 2019. Uncertainty and lack of visibility on the impact of biosimilar launches on key drugs, Neulasta, Sensipar, Epogen and Enbrel, coaxed management to issue a tepid outlook for 2019.

However, Amgen is progressing with its pipeline and the approval of Aimovig was a huge boost. In the past five years, Amgen has launched nine products, including two in new therapeutic areas

Amgen is also rapidly advancing its pipeline. Amgen boasts a strong biosimilars pipeline, which could be an important long-term growth driver for the company. Amgen achieved several important milestones with its biosimilars portfolio last year including its first two launches – Amjevita and Kanjinti. It expects to launch additional biosimilars in 2019.

Zacks Rank

Amgen currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

Pfizer Inc. (PFE): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Mylan N.V. (MYL): Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA): Get Free Report

Original post