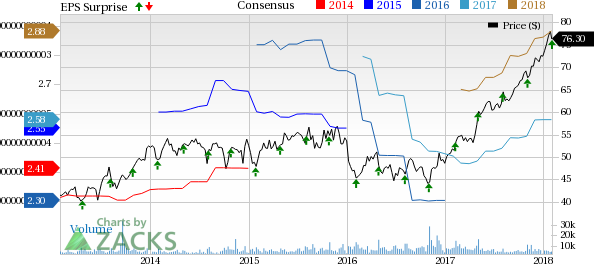

AMETEK, Inc. (NYSE:AME) reported fourth-quarter 2017 adjusted earnings of 70 cents per share, which beat the Zacks Consensus Estimate by 3 cents and increased 20.7% from the year-ago quarter.

Net sales increased 17.5% year over year to $1.14 billion, driven by robust organic growth and strong contribution from acquisitions. Organic sales growth was 9%.

The company continues to reap benefits from the execution of its four core growth strategies of operational excellence, global market expansion, investments in product development and strategic acquisitions.

Quarter Details

EIG sales (almost 65% of net sales) increased 20.4% on a year-over-year basis to $741.5 million. The upside was attributed to robust broad-based organic growth (up 9%) and contribution from MOCON and Rauland acquisitions.

EMG sales (almost 35% of net sales) increased 12.5% on a year-over-year basis to $401.6 million. The year-over-year improvement was primarily due to solid organic growth (up 10%) and solid contribution from Laserage acquisition.

Selling, general and administrative (SG&A) expenses, as percentage of sales, increased 40 basis points (bps) to 12.4%.

Adjusted operating margin expanded 10 bps on a year-over-year basis to 22%. EIG segment operating margin was almost flat at 26.4%. EMG segment operating margin expanded 80 bps to 18.5%.

Balance Sheet

As of Dec 31, 2017, cash and cash equivalents was $646.3 million, down from $736.4 million as of Sep 30, 2017.

Long-term debt was $1.87 billion, down from $1.92 billion in the previous quarter.

Outlook

For first-quarter of 2018, AMETEK expects sales to be up low-double digits year over year. Earnings are expected in the range of 70-72 cents per share, up 17-20% year over year. The Zacks Consensus Estimate is currently pegged at 68 cents.

For 2018, AMETEK expects sales to increase approximately 7-9%, driven by contributions from recent acquisitions and 3-5% organic sales growth. Earnings are expected to in the range of $2.95-$3.05 per share, up 13-17% year over year. The Zacks Consensus Estimate for earnings is currently pegged at $2.88.

Zacks Rank & Stocks to Consider

Currently, AMETEK carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader technology sector are Micron Technology (NASDAQ:MU) , Lam Research (NASDAQ:LRCX) and The Trade Desk (NASDAQ:TTD) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Micron, Lam Research and The Trade Desk is projected at 10%, 14.85% and 25%, respectively.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

The Trade Desk Inc. (TTD): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

AMETEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research