Amerisafe Inc. (NASDAQ:AMSF) reported second-quarter 2017 operating earnings per share of 81 cents which surpassed the Zacks Consensus Estimate by 12.5%. However, earning declined 7% year over year due to a 3.4% fall in operating income.

Quarter in Detail

Amerisafe’s total operating revenue decreased 7.8% year over year to $90 million. The top line also missed the Zacks Consensus Estimate by 5.3%

Gross premiums written in the quarter decreased 15.7%, primarily due to lower voluntary premiums written and lower payroll audits.

Net investment income increased 20.5% to $7.5 million in the quarter, largely due to a significant decline in value of an investment in a limited partnership hedge fund in last-year quarter.

Total expenses came in at $67.8 million, down 7% year over year. For the second quarter, the underwriting expense ratio was 24.4%, improving 50 basis points (bps) from the prior-year quarter. The improvement came on the back of lower loss-based assessments and lower commissions year over year.

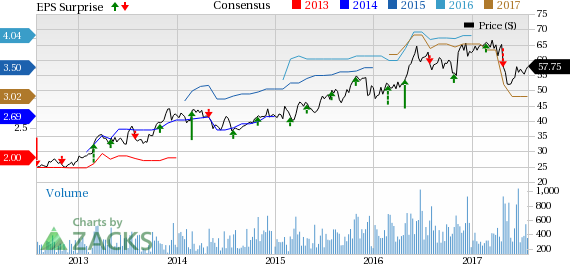

AMERISAFE, Inc. Price, Consensus and EPS Surprise

Financial Update

Amerisafe exited the quarter with cash and cash equivalents of $54 million, down 8.5% from year-end 2016.

As of Jun 30, 2017, total shareholders’ equity was $481 million, up 5.5% from the end of 2016.

Operating return on equity was 13.3%, down 30 bps year over year.

Book value per share as of Jun 30, 2017 was $25.02, down 3.1% year over year.

Dividend and Share Repurchase Update

The company paid a regular quarterly cash dividend of 20 cents per share on Jun 23, 2017.

During the quarter, no shares were repurchased under the company’s share repurchase plan.

Zacks Rank

Amerisafe currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Performance of Other Insurers

Among other players in the same space that have reported their second-quarter earnings so far, the bottom lines of The Progressive Corporation (NYSE:PGR) and The Travelers Companies, Inc. (NYSE:TRV) missed their respective Zacks Consensus Estimate while RLI Corp. (NYSE:RLI) beat the same.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's second traillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

AMERISAFE, Inc. (AMSF): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

The Travelers Companies, Inc. (TRV): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research