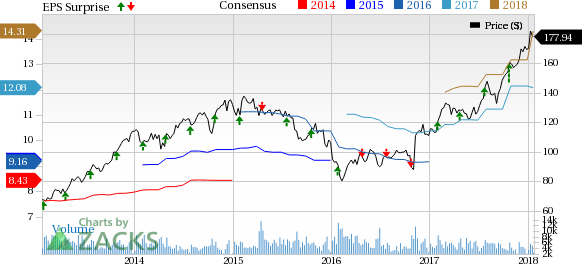

Ameriprise Financial Inc.’s (NYSE:AMP) fourth-quarter 2017 adjusted operating earnings per share of $3.26 comfortably surpassed the Zacks Consensus Estimate of $3.09. Also, the figure compares favourably with $2.73 per share registered in the year-ago quarter.

Results benefited from an improvement in revenues. Also, growth in assets under management (AUM) and assets under administration (AUA) were on the positive side. However, a rise in expenses acted as a headwind.

After taking into consideration the impact of the Tax Act, net income for the reported quarter came in at $181 million or $1.18 per share, down from $400 million or $2.46 per share in the prior-year quarter.

For 2017, adjusted operating earnings came in at $12.27 per share, up from $8.48 per share registered in 2016. Also, the figure surpassed the Zacks Consensus Estimate of $12.10. After taking into consideration the Tax Act related adjustment, net income for 2017 came in at $1.48 billion or $9.44 per share, reflecting an increase from $1.31 billion or $7.81 per share registered in the prior year.

Revenues Improve, Costs Escalate

Net revenues (on a GAAP basis) were $3.16 billion for the quarter, reflecting 3.2% increase from the year-ago quarter. Also, it surpassed the Zacks Consensus Estimate of $3.03 billion.

For 2017, GAAP net revenues were $12.03 billion, up 2.8% from 2016. Also, the figure surpassed the Zacks Consensus Estimate of $11.97 billion.

On an operating basis, total net revenues came in at $3.11 billion for the quarter, increasing 5.9% from the prior-year quarter.

Operating expenses came in at $2.51 billion, increasing 4.5% from the prior-year quarter.

Strong AUM & AUA

As of Dec 31, 2017, total AUM and AUA was $897.04 billion, reflecting an increase of 13.9% year over year, primarily driven by Ameriprise advisor client net inflows and market appreciation.

Capital Deployment

In the reported quarter, Ameriprise repurchased 1.9 million shares for $302 million. In 2017, the company repurchased 9.9 million shares for $1.3 billion.

Our Take

Ameriprise remains well positioned to grow inorganically through strategic acquisitions, given a solid liquidity position. Also, its efforts toward modifying its product and service-offering capacity are expected to support top-line growth in the quarters ahead.

Although the company has been taking initiatives to strengthen expense management, advertising campaign and technology upgrades are likely to keep expenses elevated in the near term.

At present, Ameriprise carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Upcoming Releases of Other Asset Managers

BlackRock, Inc.’s (NYSE:BLK) fourth-quarter 2017 adjusted earnings of $6.24 per share outpaced the Zacks Consensus Estimate of $6.08. Results benefited from an improvement in revenues, rise in assets under management and steady long-term inflows. However, increase in operating expenses acted as a headwind.

T. Rowe Price Group, Inc. (NASDAQ:TROW) is expected to release results on Jan 30, while The Blackstone Group L.P. (NYSE:BX) is scheduled to come up with its financial numbers on Feb 1.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

T. Rowe Price Group, Inc. (TROW): Free Stock Analysis Report

AMERIPRISE FINANCIAL SERVICES, INC. (AMP): Free Stock Analysis Report

The Blackstone Group L.P. (BX): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Original post

Zacks Investment Research