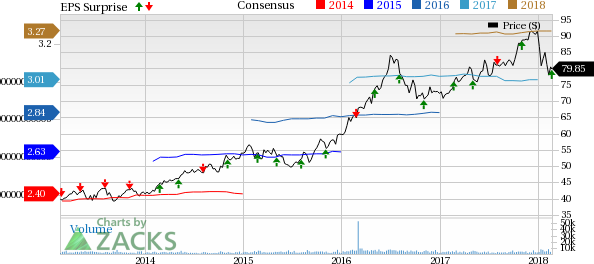

American Water Works Company (NYSE:AWK) posted fourth-quarter 2017 earnings per share of 69 cents, which beat the Zacks Consensus Estimate of 66 cents by 4.5%. Earnings improved 21% from the year-ago quarter.

The improvement came on the back of growth in Regulated Businesses, which was primarily driven by infrastructure investment, acquisitions and organic growth. The Market-Based Businesses were bolstered by Homeowner Services Group.

Total Revenues

Total revenues of $821 million missed the Zacks Consensus Estimate of $835 million by 1.7%. However, reported revenues were up 2.4% year over year.

Highlights of the Release

Total operating expenses in the quarter were $542 million, down 2.2% from the year-ago quarter. The savings was primarily caused by lower operation & maintenance and lower depreciation & amortization expenses compared with the year-ago quarter.

Operating income was $279 million, up 12.5% year over year.

Segment Details

Regulated businesses’ net income was $119 million, up 21.4% from $98 million reported in the year-ago quarter. In the fourth quarter, net depreciation was favored by the implementation of new depreciation rates in Illinois subsidiary and O&M expense was benefitted by the timing of expenditures last year and continued focus on cost management.

Market-based businesses’ net income was $14 million compared with $13 million in the year-ago quarter. The year-over-year increase can be attributed to growth in the Homeowner Services Group through customer gain and price increases.

Financial Highlights

Cash and cash equivalents were $55 million as of Dec 31, 2017, down from $75 million as of Dec 31, 2016.

Long-term debt was $6,498 million as of Dec 31, 2017, higher than $5,759 million as of Dec 31, 2016.

The company made capital investments of $1.7 billion in 2017, including $1.4 billion to improve infrastructure in the Regulated Businesses to provide safe, clean and reliable service and over $210 million for regulated acquisitions.

Guidance

American Water Works affirmed 2018 earnings per share guidance in the range of $3.22-$3.32 and long-term EPS growth at 7-10 % from a 2016 base.

Zacks Rank

American Water Works carries a Zacks Rank #4 (Sell).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Peer Releases

American States Water Company (NYSE:AWR) , a Zacks Rank #3 (Hold) stock, is expected to report fourth-quarter 2017 results on Feb 26. The Zacks Consensus Estimate for earnings is pegged at 35 cents.

Consolidated Water Company Ltd. (NASDAQ:CWCO) , a Zacks Rank #3 stock, is expected to report fourth-quarter 2017 results on Mar 15. The Zacks Consensus Estimate for earnings is pegged at 18 cents.

Connecticut Water Services Inc. (NASDAQ:CTWS) carries a Zacks Rank #3 and is expected to report fourth-quarter 2017 results on Mar 12 .The Zacks Consensus Estimate for earnings is pegged at 21 cents.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Connecticut Water Service, Inc. (CTWS): Free Stock Analysis Report

American Water Works (AWK): Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO): Free Stock Analysis Report

American States Water Company (AWR): Free Stock Analysis Report

Original post

Zacks Investment Research