American Tower Corp. (NYSE:AMT) is a real estate investment trust and a leading wireless tower operator. The firm through its subsidiaries owns, operates and develops wireless and broadcast communications real estate.

Notably, American Tower has been aggressively buying towers in emerging markets. We believe the company’s acquisition spree should help drive its top line, going forward. Moreover, American Tower is certain that strength in its tower portfolio will help it double its AFFO per share by 2017. Further, higher adoption of smartphones/tablets, increased deployment of 3G/4G networks, significant margin improvement and dividend hikes also bode well.

On the flip side, the ongoing consolidation trend among telecom and cable TV operators may generate significant financial uncertainty for the company. Moreover, American Tower has a substantially leveraged balance sheet. High customer concentration is likely to affect the company’s top line. Expansion in the global market increases the company’s exposure to foreign currency exchange rate risks. Stiff competition, integration risks and rising operating expenses are other headwinds.

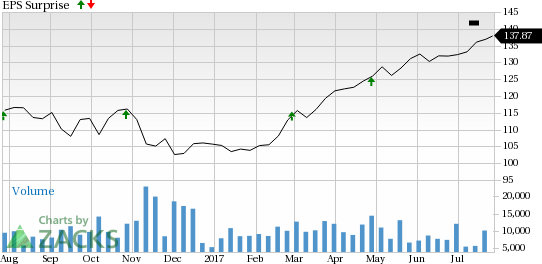

Zacks Rank: American Tower currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: American Tower reported second-quarter 2017 adjusted AFFO per share of $1.68. This figure is higher than the Zacks Consensus Estimate of $1.55. Investors should note that these figures take out stock option expenses.

Revenue: Quarterly total revenue of $1,662.4 million also surpassed the Zacks Consensus Estimate of $1,644.6 million.

Key Stats to Note: In the property segment, the company’s core growth was 14.9% in the second quarter of 2017.

Check back later for our full write up on this American Tower earnings report later!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future. Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

American Tower Corporation (REIT) (AMT): Free Stock Analysis Report

Original post