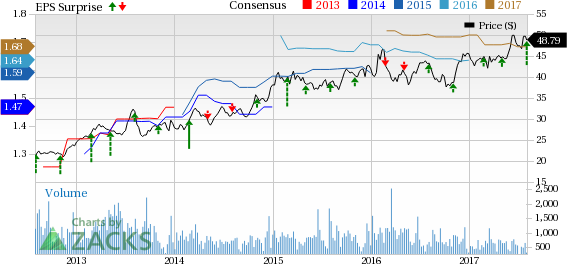

American States Water Company (NYSE:AWR) reported second-quarter 2017 earnings of 62 cents per share, beating the Zacks Consensus Estimate of 45 cents by 37.8%.

The outperformance came on the back of higher contribution from its Water and Contracted Services segments.

Revenue

American States Water’s operating revenues in the quarter were $113.2 million, surpassing the Zacks Consensus Estimate of $107 million by 5.8%. Revenues also increased 1.1% year over year.

Operational Update

In the quarter under review, American States Water’s total operating expenses were $71.4 million, down 12.3% year over year.

American States Water’s interest expenses were $5.9 million, up 5.4% year over year.

Segment Details

Water segment earnings during the quarter were 48 cents, up 33.3% year over year. The upside was due the recognition of a pretax gain of $8.3 million. This gain was partially offset by a decrease in the water gross margin of $1.8 million.

Electric segment earnings were 2 cents, rising 100% year over year. This was primarily due to lower consulting and outside service costs, further supported by lower-effective income tax rate for the electric segment.

Contracted Services segment earnings increased 71.4% to 12 cents as a result of the U.S. government’s approval of the third price redetermination for Fort Bragg in North Carolina, retroactive to Mar 2016. This helped the company gain excess of $1.6 million, in additional management fee revenue.

Financial Update

As of Jun 30, American States Water’s cash and cash equivalents were $2.1 million compared with $0.4 million as of Dec 31, 2016.

The company’s long-term debts amounted to $321 million, in line with the figure of Dec 31, 2016.

Net cash from operating activities in the first half of 2017 was $75.4 million, up from $48.5 million in the year-ago period.

Zacks Rank

American States Water currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Peer Releases

Connecticut Water Service, Inc. (NASDAQ:CTWS) is expected to release second-quarter earnings on Aug 8. The Zacks Consensus Estimate for the quarter is pegged at 68 cents.

Consolidated Water Co. Ltd. (NASDAQ:CWCO) is expected to release second-quarter earnings on Aug 9. The Zacks Consensus Estimate for the quarter is pegged at 16 cents.

Global Water Resource Inc. (NASDAQ:GWRS) is scheduled to release second-quarter earnings on Aug 8. The Zacks Consensus Estimate for the quarter is pegged at 4 cents.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Connecticut Water Service, Inc. (CTWS): Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO): Free Stock Analysis Report

American States Water Company (AWR): Free Stock Analysis Report

Global Water Resources, Inc. (GWRS): Free Stock Analysis Report

Original post

Zacks Investment Research