American Express Company (NYSE:AXP) is trading slightly lower this afternoon, after Oppenheimer lowered its price target on the Dow name to $111 from $113. This bear note is not completely unheard of for AXP, as 10 out of 19 covering firms sport tepid "hold" ratings. What's more, it comes just before the lending company is scheduled to report third-quarter earnings, with the event slated for after the market closes tomorrow, Oct. 18.

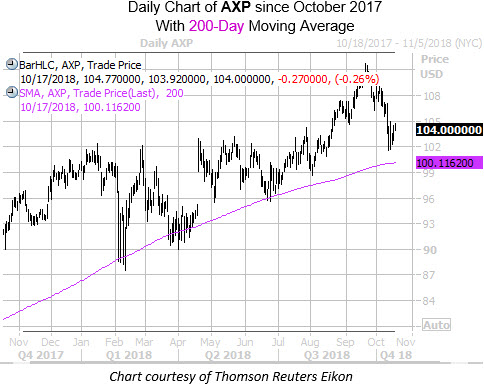

Overall, American Express stock has been moving higher on the charts, though it has suffered a handful of notable pullbacks since early February. Limiting those losses has been the 200-day moving average, which also helped push the stock to a recent all-time peak of $111.77 on Sept. 20. AXP is just above breakeven year-to-date, last seen down 0.3% at $104.

Digging into its earnings history, AXP closed lower the day after reporting in five of the last eight quarters, including a 2.7% drop after its late-July report. Looking broader, the shares have averaged a 3.6% move the day after earnings over the last two years, regardless of direction. This time around, options traders are pricing in a larger-than-usual 5.1% swing for Friday's trading.

In the options pits, however, sentiment has been bullish toward the financial name. Specifically, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows American Express stock with a 10-day call/put volume ratio of 2.07, ranking in the 99th annual percentile. In other words, call buying has doubled put buying during the past two weeks.

Lastly, the security's Schaeffer's Volatility Scorecard (SVS) is 83 out of 100. This lofty ranking shows a tendency to make larger-than-expected moves on the charts compared to what the options market has priced in over the past year.