American Express Company (NYSE:AXP) just released its fourth-quarter 2017 financial results, posting adjusted earnings of $1.58 per share and revenues of $8.84 billion. Currently, AXP is a Zacks Rank #2 (Buy) and is down 1.69% to $98.20 per share in after-hours trading shortly after its earnings report was released.

AXP:

Beat earnings estimates. The company posted adjusted earnings of $1.58 per share, beating the Zacks Consensus Estimate of $1.54 per share.

Beat revenue estimates. The company saw revenue figures of $8.84 billion, topping our consensus estimate of $8.72 billion.

The credit card giant posted a fourth-quarter net loss of $1.19 billion, or $1.41 per share. The loss was due in large part to its previously disclosed charge related to the new GOP tax plan of $2.6 billion.

For the quarter, American Express revenues were up 10% year-over-year. American Express full-year sales rose 4% to reach $33.5 billion.

“We ended the year with record billings and strong loan growth, which helped drive a 10 percent increase (up 9 percent FX-adjusted3) in revenues this quarter,” CEO Kenneth Chenault said in a statement.

“Card Member spending grew 11 percent with strong momentum across each of our business segments. Loans grew 14 percent in the quarter while credit metrics remained strong and were again in line with our expectations.”

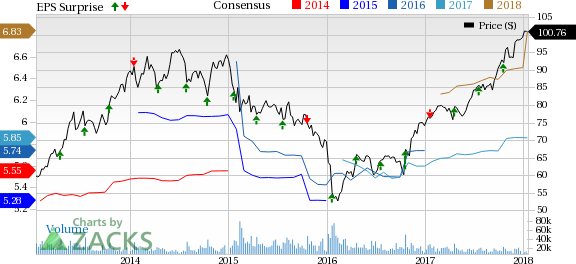

Here’s a graph that looks at AXP’s Price, Consensus and EPS Surprise history:

American Express Company is primarily engaged in the business of providing travel related services, financial advisory services and international banking services throughout the world. American Express Travel Related Services Company, Inc. provides a variety of products and services, including, global network services, the American Express Card, the Optima Card and other consumer and corporate lending products, stored value products, and several others.

Check back later for our full analysis on AXP’s earnings report!

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

American Express Company (AXP): Free Stock Analysis Report

Original post

Zacks Investment Research