We expect American Express Co. (NYSE:AXP) to beat expectations when it reports second-quarter results on Apr 19, before market opens.

Why a Likely Positive Surprise?

Our proven model shows that American Express has the right combination of the two key ingredients to beat earnings estimates.

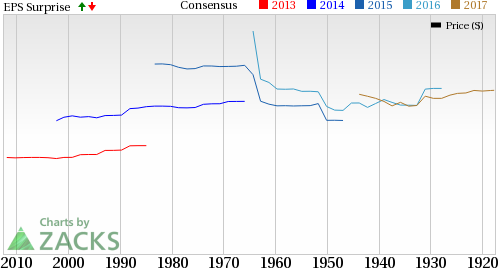

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is +2.04%. This is because the Most Accurate estimate of $1.50 is pegged higher than the Zacks Consensus Estimate of $1.47. The positive ESP is a meaningful indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: American Express carries a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank of #1, 2 or 3 have a significantly higher chance of beating on earnings.

Sell-rated stocks (#4 or 5) should never be considered going into an earnings announcement.

What is Driving the Better-Than-Expected Earnings?

We expect American Express’ second-quarter results to showcase the benefits of its cost reduction efforts over the last couple of years.

Continued return of significant capital to shareholders through its dividend and share buyback programs will aid bottom line

The company’s Global Commercial Services segment is expected to give a muted performance as travel and entertainment spending by large corporations remains at low levels.

We expect to see higher net card fees driven by continued strength in its premium U.S. portfolios including Platinum, Gold and Delta, as well as growth in key international markets like Japan and Australia.

Second-quarter results will likely reflect an increase in loan lending. Also, focus on existing card members and increased use of digital channels is expected to drive new card issuance.

Nevertheless, card spending volumes at another of the company’s segments — Global Network and Merchant Services — is expected to be under pressure due to the changing regulatory environment specifically in the European Union, Australia and China.

We also expect to see higher reward expense, which will weigh on margins, as the company has made enhancements to its U.S. platinum products to woo and retain its customers.

Other Stocks That Warrant a Look

Here are some companies that you may also consider as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Humana Inc. (NYSE:HUM) is expected to report second-quarter 2017 earnings results on Aug 2. The company has an Earnings ESP of +0.98% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cigna Corp. (NYSE:CI) has an Earnings ESP of +0.81% and a Zacks Rank #2. The company is expected to report second-quarter earnings results on Aug 4.

Comerica Inc. (NYSE:CMA) has an Earnings ESP of +4.67% and a Zacks Rank #2. The company is expected to report second-quarter earnings results on Jul 18.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Comerica Incorporated (CMA): Free Stock Analysis Report

American Express Company (AXP): Free Stock Analysis Report

Cigna Corporation (CI): Free Stock Analysis Report

Humana Inc. (HUM): Free Stock Analysis Report

Original post