American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) posted adjusted earnings of 89 cents per share for the fourth quarter, beating the Zacks Consensus Estimate of 77 cents. The reported figure excludes the impact of restructuring and acquisition-related costs, debt-refinancing and redemption costs plus non-recurring items including the tax effect. In fourth-quarter 2016, adjusted earnings were 78 cents.

The company reported net income of $106.3 million or 93 cents per share in the fourth-quarter 2017 compared with $46.9 million or 59 cents in the year-ago quarter.

Revenues increased to $1.73 billion in the reported quarter from the year-ago figure of $946.5 million. The top line also surpassed the Zacks Consensus Estimate of $1.69 billion.

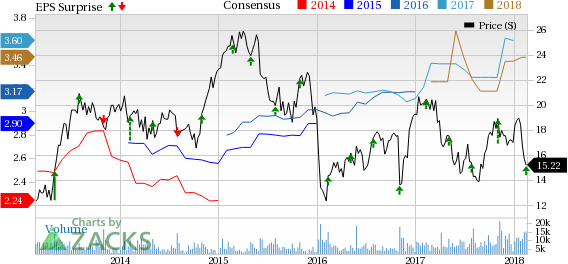

American Axle & Manufacturing Holdings, Inc. Price, Consensus and EPS Surprise

American Axle’s SG&A (Selling, General & Administrative) expenses were $101 million for the reported period in comparison to $83 million in the prior-year quarter.

Gross profit increased to $294.3 million in fourth-quarter 2017 from $176.1 million in the prior-year quarter. Operating income increased to $148.6 million from $69.5 million a year ago.

Full-Year 2017 Results

American Axle reported adjusted earnings of $3.75 per share in 2017, up from $3.3 per share earned in 2016.

Net income was $337 million from $240.7 million, recorded in 2016. Revenues increased to $6.27 billion from $3.95 billion in 2016.

Financial Position

American Axle had cash and cash equivalents of $376.8 million as of Dec 31, 2017, up from $481.2 million as of Dec 31, 2016. Long-term debt was $4 billion as of Dec 31, 2017 compared with $1.4 billion on Dec 31, 2016.

Cash flow from operations in fourth-quarter 2017 was $226 million in comparison to the prior year's figure of $117 million. At the quarter-end, American Axle’s adjusted free cash flow was $50.9 million, compared with $62.8 million for the same period last year. The figure excludes the impact of cash payments for restructuring and acquisition-related costs, settlements of pre-existing accounts payable balances with acquired entities and interest payments upon the settlement of acquired company debt.

2018 Outlook

For 2018, the company’s sales expectation is roughly $7 billion, mostly depending on its anticipated program launches and assumption that the U.S. industry sales on a seasonally adjusted annualized rate (SAAR) will be within the range of 16.8-17 million light-vehicle units in 2018.

Further, adjusted earnings before income taxes, depreciation and amortization (EBITDA) margin is expected to be in the range 17.5-18% of sales in 2018. Also, American Axle’s guidance for adjusted free cash is assumed to be 5% of sales in 2018.

Zacks Rank & Key Picks

American Axle has a Zacks Rank #3 (Hold). Some better-ranked stocks in the auto space are AB Volvo (OTC:VLVLY) , Lear Corporation (NYSE:LEA) and Daimler AG (OTC:DDAIF) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Volvo has an expected long-term growth rate of 15%. The company’s stock has seen the Zacks Consensus Estimate for quarterly earnings being revised 6.5% upward over the last 30 days.

Lear Corp. has an expected long-term growth rate of 7.1%. In the last six months, shares of the company have jumped 33.1%.

Daimler has an expected long-term growth rate of 5%. In the last six months, shares of the company have gained 27.2%.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks. >>

Daimler AG (DDAIF): Free Stock Analysis Report

American Axle & Manufacturing Holdings, Inc. (AXL): Free Stock Analysis Report

Lear Corporation (LEA): Free Stock Analysis Report

AB Volvo (VLVLY): Free Stock Analysis Report

Original post

Zacks Investment Research