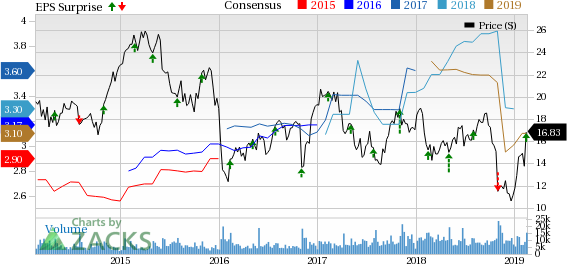

American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) posted adjusted earnings of 45 cents per share in the fourth quarter, beating the Zacks Consensus Estimate of 43 cents. In fourth-quarter 2017, adjusted earnings were 89 cents.

During the quarter under review, the company reported net loss of $361.8 million or loss of $3.24 per share against net income of $106.3 million or 93 cents per share in the year-ago quarter.

Revenues decreased to $1.69 billion from the year-ago figure of $1.73 billion. The top line slightly surpassed the Zacks Consensus Estimate of $1.68 billion.

American Axle’s SG&A (Selling, General & Administrative) expenses were $97.1 million for fourth-quarter 2018 in comparison with $101 million in the prior-year quarter.

Gross profit decreased to $225.3 million in fourth-quarter 2018 from $294.3 million in the year-ago quarter. Operating loss during the reported quarter was $394.3 million against operating income of $148.6 million in fourth-quarter 2017.

2018 Results

For 2018, American Axle reported earnings of $3.28 per share, down from the 2017 figure of $3.75.

Net sales in 2018 were $7.27 billion, up from $6.27 billion in 2017.

Financial Position

American Axle had cash and cash equivalents of $476.4 million as of Dec 31, 2018, up from $376.8 million as of Dec 31, 2017. Net long-term debt was $3.7 billion as of Dec 31, 2018, compared with $4 billion as of Dec 31, 2017.

Cash flow from operations for the three months ending Dec 31, 2018, was $258.3 million in comparison with $226.3 million recorded in the prior-year period. For the three months ending, Dec 31, 2018, American Axle’s adjusted free cash inflow was $142.4 million compared with an inflow of $50.9 million for the three months ending, Dec 31, 2017.

Outlook

For 2019, the company expects sales of $7.3-$7.4 billion.

American Axle anticipates adjusted earnings before income taxes, depreciation and amortization (EBITDA) of $1.20-$1.25 billion. The company set adjusted free cash flow target of $350-$400 million for 2019.

Zacks Rank & Other Key Picks

American Axle currently carries a Zacks Rank #1 (Strong Buy).

A few other top-ranked stocks in the auto space are Oshkosh Corp. (NYSE:OSK) , General Motors Company (NYSE:GM) and AB Volvo (OTC:VLVLY) . While Oshkosh currently sports a Zacks Rank #1, General Motors and Volvo carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Oshkosh has an expected long-term growth rate of 11.3%. Over the past three months, shares of the company have surged 19.2%.

General Motors has an expected long-term growth rate of 8.5%. Over the past three months, shares of the company have risen 9.6%.

Volvo has an expected long-term growth rate of 5%. Over the past three months, shares of the company have risen 5.7%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

General Motors Company (GM): Free Stock Analysis Report

Oshkosh Corporation (OSK): Free Stock Analysis Report

American Axle & Manufacturing Holdings, Inc. (AXL): Free Stock Analysis Report

AB Volvo (VLVLY): Free Stock Analysis Report

Original post