American Airlines Group (NASDAQ:AAL) will report earnings before the open on Friday, April 26. Ahead of the event, AAL shares just flashed a historically bearish signal on the charts, and the options market is pricing in a bigger-than-usual post-earnings move for tomorrow's trading.

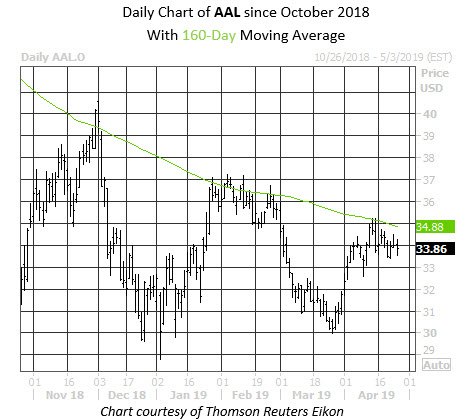

For most of 2019, American Airlines stock has consolidated below its 160-day moving average. The equity is now within one standard deviation of this trendline once more, after a lengthy stretch below it (it's been toppled on a daily closing basis only four times in 2019). There have been six similar run-ups to this moving average in the last three years, after which AAL stock was lower one month later by 11.2%, on average, per data from Schaeffer's Senior Quantitative Analyst Rocky White, with just 20% of the returns positive.

At last check, AAL was down 0.4% to trade at $33.86. A drop of similar magnitude would put the stock just above the $30 a month from now, and back below its year-to-date breakeven level. The only solace is that round-number area has cushioned pullbacks for the last few months.

Over the past eight quarters, the security's one-day earnings reaction was negative four times, the last occurring one year ago. On average, AAL swung 4.8% the day after earnings over the past two years, regardless of direction. This time around, the options market is pricing in a 6.8% swing -- notable, considering the stock has not made one post-earnings move larger than 6.7% in the past two years.