American Airlines Group (NASDAQ:AAL) came into existence following the Dec 2013 merger of AMR (American Airlines' parent group) and US Airways. This Fort Worth, Texas based company serves customers with more than 6,700 daily flights in more than 50 nations across the globe.

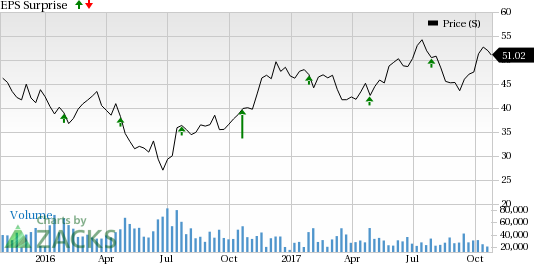

American Airlines Group has a healthy track record with respect to earnings. The company has delivered positive earnings surprises in three of the last four quarters, with an average beat of 19.1%.

Zacks Rank: Currently, American Airlines Group has a Zacks Rank #5 (Strong Sell), but that could change following the company’s earnings report which was just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: American Airlines Group beat on earnings. Adjusted earnings per share came in at $1.42 per share, beating the Zacks Consensus Estimate by 3 cents. Quarterly earnings declined significantly on a year over year basis due to high costs. Results were also hurt by the recent hurricanes. During the third quarter, the company had to cancel more than 8,000 flights due to the hurricanes (Harvey, Irma and Maria). Consequently, its pre-tax earnings was hurt by approximately $75 million in the quarter.

Revenue: Revenues of $10,878 million were 2.7% above the year-ago figure. The Zacks Consensus Estimate for third-quarter revenues of $10,882.9 million. Total revenue per available seat miles (TRASM) increased 1.1% in the quarter.

Key Stats: American Airlines Group’s bottom-line in the quarter was hurt by higher labor costs. Cost per available seat mile excluding fuel and special items increased 4.5% on a year over year basis. During the quarter, the company returned $411 million billion to its shareholders through the payment of $49 million in dividends and buyback of shares worth $362 million. Furthermore, the carrier also declared a dividend of $0.10 per share. The dividend will be paid on Nov 27, to the shareholders on Nov 13. We are impressed by the company’s efforts to reward shareholders through stock repurchases and dividend payments. TRASM is expected to increase in the band of 2.5% to 4.5% in the fourth quarter. Pre-tax margin excluding special items is projected in the range of 4.5% to 6.5%.

Stock Price: The earnings report found favor with investors. Consequently, shares of the company were up in pre-market trading at the time of writing.

Check back later for our full write up on this American Airlines Group earnings report later!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

American Airlines Group, Inc. (AAL): Free Stock Analysis Report

Original post

Zacks Investment Research