The biggest profits during the gold rush of the 19th century were made by those selling picks and shovels. Similarly, graphics cards providers are currently making a killing as the crypto mania inspires a lot of people to spend big on mining equipment. As Intel (NASDAQ:INTC) stock keeps tracking the Elliott Wave path, it is time to take a look at the price chart of Advanced Micro Devices (NASDAQ:AMD) Inc. or simply AMD.

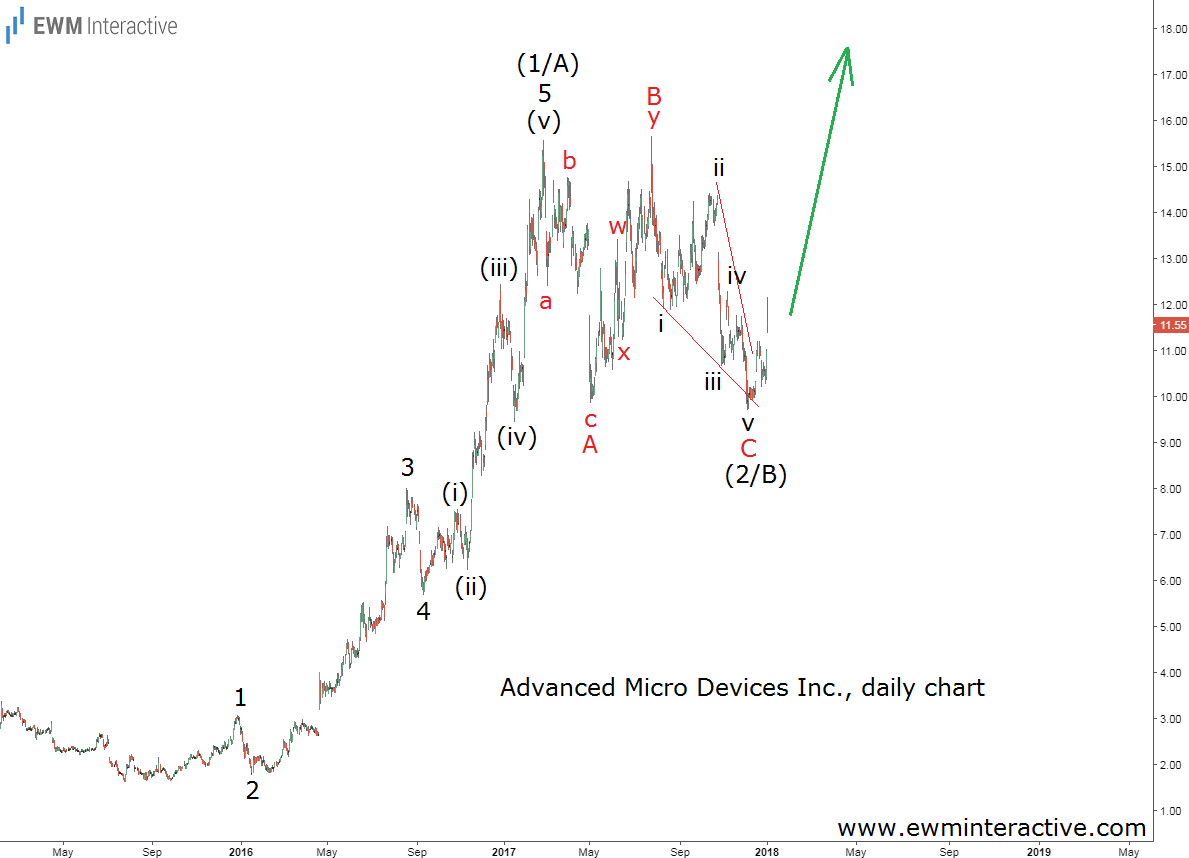

The daily chart of AMD stock visualizes its entire price development since the low at $1.61 in July, 2015. By late-February, 2017, the stock had climbed by as much as 866% to as high as $15.55. What interests us as Elliott Wave analysts is the fact that this impressive rally could be seen as a five-wave impulse, which comes to tell us that AMD is in an uptrend. However, every impulse is followed by a correction of three waves in the opposite direction. AMD’s corrective decline appears to be an A-B-C expanding flat correction with an ending diagonal in the position of wave C.

If this count is correct, the 5-3 wave cycle is complete and the trend is supposed to resume in the direction of the impulsive pattern. Wave (3/C) has the potential to exceed the top of wave (1/A), which means levels above $15.55 could be expected from now on, giving the stock 35% upside potential from current levels. Unless the Bitcoin bubble pops, of course.