Advanced Micro Devices Higher After Last 2 Earnings Reports

Semiconductor concern Advanced Micro Devices (NASDAQ:AMD) is set to step up to the earnings plate after the close on Wednesday, July 25. The security is flashing a bullish signal ahead of the event, suggesting AMD stock could be on the verge of a breakout to the upside.

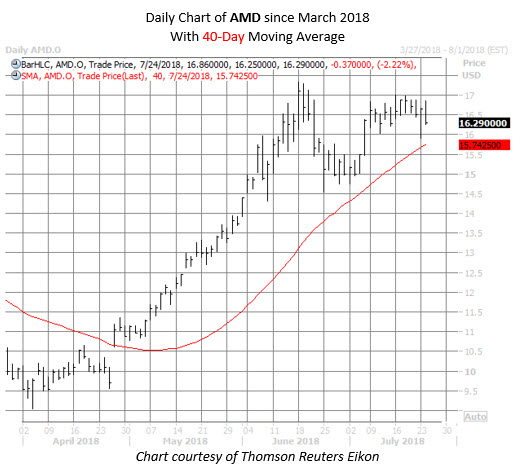

Advanced Micro Devices stock touched an 11-year high of $17.34 in mid-June. Since then – and in the wake of a 60% rally in the past three months – the equity has consolidated in the $16-$17 area. At last check, the shares are down 2.2% on the day, trading at $16.29.

However, AMD shares are now within one standard deviation of their 40-day moving average, after a lengthy stint above this trendline. There have been eight other signals of this kind, after which AMD went on to rally an average of 10.81% in the next month, per data from Schaeffer's Senior Quantitative Analyst Rocky White. From the security's current perch, a similar rally would put the stock around $18.05 – in new-high territory and nearly double AMD's April low of $9.04.

Advanced Micro Devices stock moved higher after three of its last four earnings releases, including a one-day pop of 13.7% in April. On average, the security has moved 12.2% the day after earnings, regardless of direction, looking back eight quarters. This time around, the options market is pricing in a slightly bigger-than-usual move of 15.1% for AMD stock on Thursday.

Should the equity once again exceed expectations, a round of upbeat analyst attention could be in store. While Cowen today reiterated an "outperform" rating and $21 price target for AMD ahead of earnings, waxing optimistic on the company's competitive edge over Intel (NASDAQ:INTC), not everyone has boarded the bullish bandwagon. In fact, 10 of 21 analysts maintain tepid "hold" recommendations. Plus, the average 12-month price target of $15.74 represents a discount to AMD's current perch, leaving the door open for price-target hikes to lure more buyers to the table.

A solid earnings showing could also spook lingering short sellers. While short interest declined by 4.5% in the most recent reporting period, nearly 20% of AMD's stock remains dedicated to short interest. A mass exodus of shorts could also help the shares break out of their recent range.