AMC Networks Inc. (NASDAQ:AMCX) reported mixed financial results in the second quarter of 2017. The bottom line outpaced the Zacks Consensus Estimate while the top line fell below the mark.

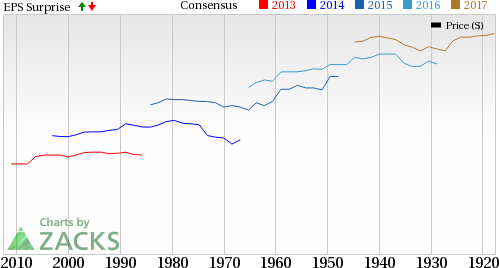

Net income was $102.6 million or $1.54 per share compared with $77.2 million or $1.05 per share in the prior-year quarter. However, quarterly adjusted earnings per share of $1.88 surpassed the Zacks Consensus Estimate of $1.41.

Quarterly total revenue of $710.5 million was up 3.8% year over year lagging the Zacks Consensus Estimate of $715 million. National Networks revenues were $604.9 million, up 5.6% year over year. International and Other revenues totaled $110.8 million, down 6.3% year over year.

Quarterly total adjusted operating income (AOI) was $228.6 million, up 8.2% year over year. National Networks AOI grossed $232.2 million, up 12.5% while International and Other AOI totaled $1 million, down 87.8%.

Operating costs and expenses totaled $534.8 million compared with $506.8 million in the prior year quarter. Operating income was $175.8 million, down 1.3% year over year. Operating margin was 24.7% compared with 26% in the prior-year quarter.

In the first half of 2017, AMC Networks generated $166 million of cash from operations compared with $229.6 million in the year-ago period. Free cash flow in the reported period was $113.1 million compared with $196.4 million in the prior-year period. At the end of second-quarter 2017, the company had $189.5 million of cash and cash equivalents and $2,747 million of debt outstanding.

AMC Networks competes in the highly competitive broadcast radio and television industry. Its major competitors like CBS Corp. (NYSE:CBS) , Gray Television Inc. (NYSE:GTN) and Entercom Communications Corp. (NYSE:ETM) . AMC Networks currently carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

CBS Corporation (CBS): Free Stock Analysis Report

AMC Networks Inc. (AMCX): Free Stock Analysis Report

Gray Television, Inc. (GTN): Free Stock Analysis Report

Original post

Zacks Investment Research