AMC Entertainment Holdings Inc. (NYSE:AMC) is one of the largest theatrical exhibition companies in the U.S., Europe and globally with approximately 1,000 theaters and 11,000 screens across the globe. AMC now operates theaters in 15 countries and is the market leader in nine of those. The company is also an industry leader in innovation and operational excellence.

AMC Entertainment has been actively involved in the renovation and refurbishing of multiplexes through enhancements like reclining seats, improved food and beverages, dine-in theaters, and advanced sound and digital equipment. To this end, the company has also rebranded the theaters acquired from its smaller rival Carmike Cinemas.

The acquisition of Stockholm-based Nordic Cinema Group Holding AB has boosted AMC Entertainment’s growth, geographical expansion. Nordic Cinemas is the largest theatre operator in the Nordic and Baltic countries. We believe this deal will lead to significant growth opportunities in key European markets.

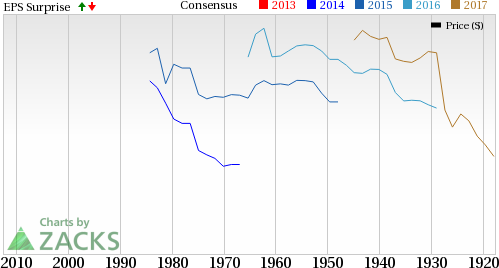

AMC Entertainment currently carries a Zacks Rank #3 (Hold). The company has generated a whopping positive average earnings surprise of 116.20% in the previous four quarters. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: AMC Entertainment posted wider-than-expected net loss in the second quarter of 2017. Our consensus adjusted net loss per share estimate was $1.33 while the company reported adjusted net loss per share of $1.35. Investors should note that these figures take out stock option expenses.

Revenue: AMC Entertainment generated total revenue of nearly $1,202.3 million, which lagged the Zacks Consensus Estimate by approximately $10 million.

Key Stats to Note: During the second quarter of 2017, Average ticket price was $9.33 compared with $9.62 for the same quarter a year ago. Food and beverage revenues per patron were $4.58 compared with $4.87 in the year-ago quarter.

Check back later for our full write up on this AMC Entertainment earnings report later!

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

AMC Entertainment Holdings, Inc. (AMC): Free Stock Analysis Report

Original post

Zacks Investment Research