Yesterday, Amazon (Nasdaq: NASDAQ:AMZN) held its inaugural Prime Day shopping event. The idea was to offer Black Friday-esque sales exclusively to Prime members, with the goal of encouraging more people to enroll in its $99-a-year program.

So was the event a success? That depends on whom you ask.

If you google “Amazon Prime Day,” more than half of the results are news outlets and blogs reporting customer outrage: items sold out too quickly... discounts weren’t as deep as advertised...

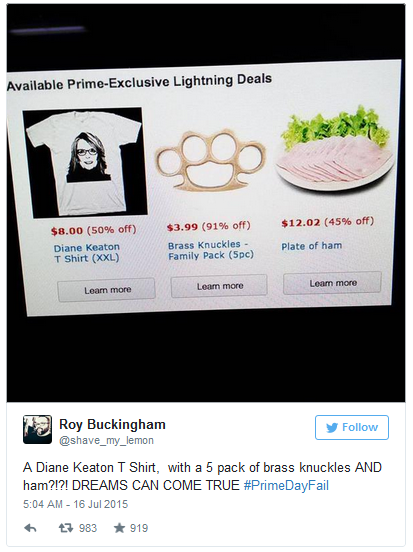

This screenshot sums up many of the negative reports:

Forbes and other financial sites considered whether Prime Day might blow up in Amazon’s face. On Twitter (NYSE:TWTR), the trending hashtag #PrimeDayFail indicated that the sale was a total bust.

And yet, that’s not at all what Amazon is reporting...

In a press release, it called Prime Day “a huge success,” boasting it sold more units than it did on its biggest Black Friday ever. “Customers ordered 34.4 million items across Prime-eligible countries... with 398 items ordered per second,” said Amazon Prime Vice President Greg Greeley.

Again, that’s 398 items ordered per second. (That’s a lot of Diane Keaton T-shirts.) Here are the highlights:

- 47,000 televisions

- 51,000 pairs of Bose headphones

- 12,000 copies of Fifty Shades of Grey on Blu-ray

- 56,000 Lord of the Rings trilogy sets

- And 14,000 iRobot Roomba vacuum cleaning robots sold.

According to Amazon, “Worldwide order growth increased 266% over the same day last year and 18% more than Black Friday 2014.” Not bad for a random Wednesday in July.

But let’s not forget...

In order to access these bargains, shoppers had to become Amazon Prime members. The company hasn’t revealed just how many new sign-ups there were, but Greeley said they numbered in the “hundreds of thousands.”

Amazon’s next earnings release should provide some hard numbers. But the fact that the company is already planning to hold another Prime Day next year should tell investors everything they need to know...

Prime Day was not, in fact, a “fail.”

As I write, shares of Amazon are trading 2.8% north of yesterday’s close. Year-to-date, they’re up more than 50%.

So what’s the lesson for investors here? Context.

Amazon is a behemoth. So no matter how Prime Day turned out, there was guaranteed to be tons of media coverage. The key to making this information useful is to consider sources carefully... to ask the right questions.

You need to understand the context.

If you did, in this instance, you could be sitting on a decent single-day gain. Because you would have known that complaints about items selling out too quickly were actually a positive sign for Prime Day’s success.

Fortunately, there will be plenty of opportunities to pay attention - and profit - in the future. After all...

Amazon still has Black Friday to look forward to.