Amazon (NASDAQ:AMZN) is in no mood to stop anywhere down the line. The online retailer has now pushed itself into another category in retail, namely skin care. The company has unveiled private-label skincare line called Belei.

The company’s product line has 12 different items that include moisturizers, eye cream and spot treatments, among others. All these Belei products range from $9-$40. These products are free of parabens, phthalates, sulfates and fragrance, and are not tested on animals.

Consequently, the latest move will aid the company to penetrate in the growing beauty industry.

Notably, per a data from The NPD Group, the U.S. beauty industry reached $18.8 billion in 2018, up 6% year over year. In particular, sales from the skin care category increased 13% year over year and contributed 60% to total industry gains. Sales from the skin care category were $5.6 billion in 2018.

Notably, this move of Amazon is a significant step toward expanding private-label products. Amazon will likely sell skin-care products at higher margins than groceries, thereby expanding profits.

Increasing Competition

Amazon has already been rolling out its own private labels for clothes, shoes, snack foods, baby diapers and mattresses, threatening other brands on its platform.

We believe Amazon’s intentions to foray into the skincare product line with its private label can cause massive disruption in this particular space due to aggressive retail strategies and vast e-commerce platform.

This new beauty initiative definitely does not bode well for brands such as Procter & Gamble's (NYSE:PG) , Olay, Estee Lauder (NYSE:EL) and Clinique, which make similar products. Also, it is a matter of concern for a few retail outlets like Sephora and Ulta, which sell these skin care products.

Growing Private Label Business

Notably, customers are becoming more inclined toward private label products as they are low-cost alternatives to national brands. Amazon’s sustained efforts toward expansion of private label business are evident from its latest move.

Apart from skin care products, the e-commerce giant rolled out toys late last year. It also launched Amazon Accelerator Program, via which it intends to bring various companies and manufacturers under its program and make them part of “Our Brands”.

Notably, Amazon has created job openings to run private label business efficiently. Moreover, it has created job opportunities for several manufactures to produce products that will fit into its huge Private Brands product family.

We believe, an expanding product portfolio on the back of home brands will aid Amazon to transform the private label business into a profit generating one.

Further, this will aid the company in fortifying its competitive position against the likes of Walmart (NYSE:WMT) , The Kroger (NYSE:KR) and Target (NYSE:TGT) , which are also leaving no stone unturned to boost their presence in private brands business.

Notably, Walmart has a huge portfolio of own brand products. Target is making advances to expand its home brand portfolio with new product introductions.

Nevertheless, Amazon’s growing initiatives for private label business, andvarious customer friendly offers and loyalty programs will continue to boost its retail position.

Zacks Rank

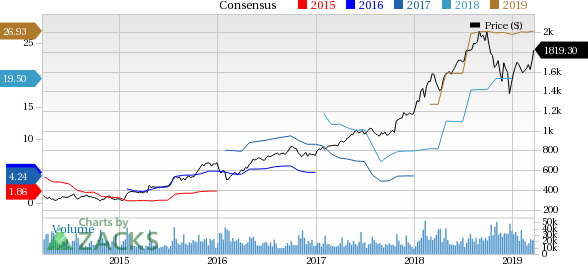

Amazon currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Procter & Gamble Company (The) (PG): Free Stock Analysis Report

Original post

Zacks Investment Research