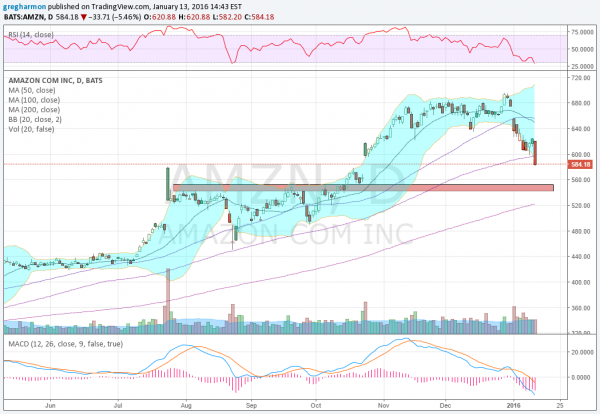

Remember way back when we were talking about how Amazon (O:AMZN) had just crushed the competition at Christmas? When was that again? Oh, yeah, 2 weeks ago. Since then the stock has given up over 70% of the gain it received from October into that New Years high at 696. Did it not crush Christmas?

Stocks rise and fall for many reasons so maybe this is just one of those times. If you liked the stock going into the holiday season, you get a chance to see how it went in just two weeks when the company reports earnings on January 28th. What will they say? Will they confirm they crushed Christmas? I do not know. But I do see an opportunity for a trade.

The chart above shows the break out zone from 540 to 550 where the stock started higher. Would you own it there if it retouched? What about the 200 day SMA, down at 520, in the midst of the consolidation? You can set yourself up for that right now by using options.

The simplest way is to sell the January 29 Expiry 540 Puts (bid at $12) or January Expiry 520 Puts ($7.45). By selling these puts you are committing to buy the stock at either 540 or 520 if it closes under that level on January 29th. But your basis if you are put the stock will be $528 or $512.55 because of the credit you get for selling the puts today. What happens if it closes on January 29th above your strike? Then you get to keep the premium from selling the puts.

A bit more complicated method is to buy a January 29 Expiry 570/540 1×2 Put Spread (80 cent credit). This buying the January 29 Expiry 570 put and selling 2 of the January 29 Expiry 540 Puts. This also obligates you to buy the stock at 540 if it closes under 540 at Expiry. But it also allows you to participate in the downside from 570 to 540 along the way. In this way if the stock closes under 540 your basis will be $510. It if closes between 570 and 540 you will make money on the put spread.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.