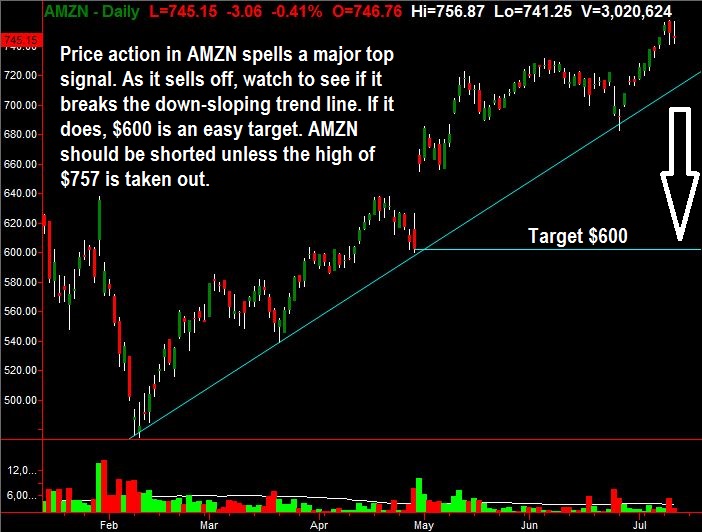

Amazon.com (NASDAQ:AMZN) is putting in the sell signal of the year. And while the stock has been a one-way freight train, that's about to reverse hard. Take a look at the 2016 price action. AMZN is up from $475 per share to a Tuesday high of $757. For this year alone, that represents a gain of almost 60%.

Target Price

Amazon's overbought nature is but a minor reason why it is about to become a huge sell -- with a target of $600. The main factor has to do with the sell signal seen on the chart in the last 24 hours. The stock rallied in the past week ahead of Tuesday's 'Prime Day' -- Amazon's made-up holiday that has, in the past, driven large swaths of shoppers to its site. But the stock sold off Tuesday on rumors that sales were not going to meet expectations. Yet by today (Wednesday) positive sales news drove the stock back up -- at least for a while.

But the good news failed to sustain the stock, let alone enable it to take out Tuesday's high. The fact that the high was not breached is a sell signal of epic proportion on a stock up 60% in 2016. And technical investors are rushing to sell or short it. If the key up-sloping trend line is broken to the downside (seen the chart), Amazon has little-to-no support until $600 -- a key gap fill.

You Heard It Here First

This may just turn out to be one of the best shorts for the second half of 2016.