There's no place like Amazon.com (NASDAQ:AMZN) for the holidays.

And CEO Jeff Bezos seems to know it. The e-retailing titan is already loading up on staffers for this holiday season, it seems, by making big investments in staffers who handle and deliver the goods (or get it as close to the consumer as possible). Here is a rundown of what Amazon (NASDAQ:AMZN) is doing with earnings on the way Thursday, October 24.

Overall, Amazon (NASDAQ:AMZN) has grown job postings 43% over the course of 2019 (not shown). And a lot of that has been focused on getting the goods to the consumer.

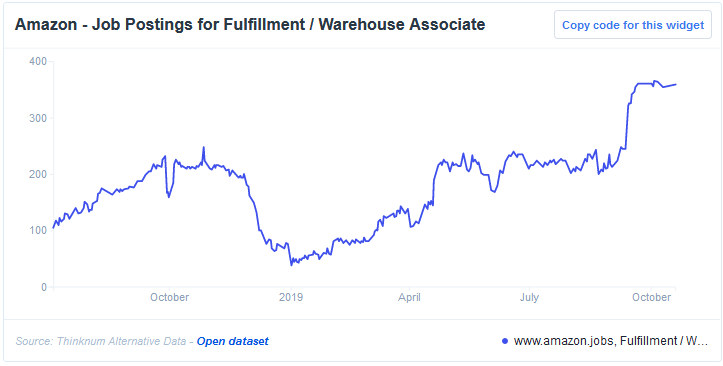

Fulfillment and Warehouse Associate roles - the people working for Amazon (NASDAQ:AMZN) that typically perform tasks like picking up packages "less than 49 pounds" and working in either seasonal or part-time positions - have grown nearly 10-fold in 2019 in terms of job postings, rising from 38 to 359.

It's clear from Amazon's hiring patterns that these jobs are posted cyclically - but this job posting category is still up well over what it was 12 months ago, the first suggestion that Amazon (NASDAQ:AMZN) is investing more in shipping and delivery.

Customer service job postings are up more than 73%. For every order I've placed think Amazon (NASDAQ:AMZN), I strain to think of a single time when things went so poorly that I had to call in to deal with the situation. Then again, Amazon is facing a different shipping and delivery scenario this holiday season, than it did a year prior.

In August, longtime delivery partner FedEx Corporation (NYSE:FDX) terminated its contract with the e-commerce titan, putting Amazon (NASDAQ:AMZN) in a position of needing to cover "last-mile" capabilities. It's likely that some of the job postings Amazon is adding will cover this gap.

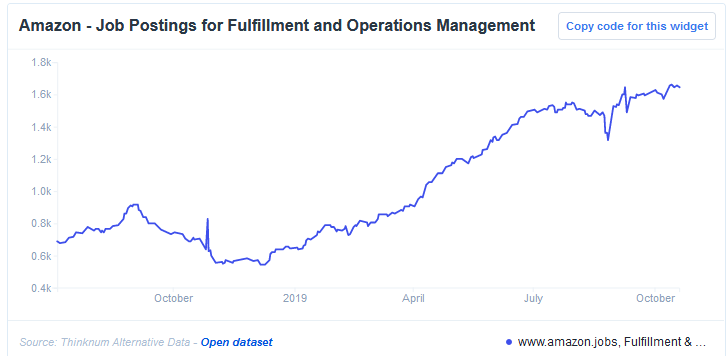

We conclude with a chart covering Fulfillment and Operations Management roles - so, the managers and senior workers, who work with the people tracked in the first chart. Here, we see job postings rising nearly 150%, in one of Amazon's biggest hiring categories - the company grew job postings in this segment to more than 1,600, again, outpacing prior years' figures at this time. Supply chain roles (not shown) are also up 50% in 2019.

Amazon (NASDAQ:AMZN) analysts tracked by Zacks Investment Research are expecting EPS $4.46 when the company announces earnings October 24; shares have risen nearly 16% year-to-date.

About the Data:

Thinknum tracks companies using the information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.