Retail superpower Amazon.com (NASDAQ:AMZN) is seeing big success in multiple product categories with its own private label brands, according to a new report.

Data analytics experts at 101data found that Amazon is having particular success with its own baby wipes, batteries, and speakers.

According to their estimates, Amazon now owns 16% of the online baby wipes market, behind leaders Huggies (33%) and Pampers (26%). Amazon Elements baby wipes sales are up 266% from last year, and as a father of two young children myself, I can confirm these baby wipes are both cheap and reliable.

Meanwhile, Amazon Basics batteries have claimed a whopping one-third of total online battery sales, and are seeing 93% year-over-year growth. What’s more 94% of total online battery sales — about $113 million annually — are happening on Amazon.com’s platform.

Amazon’s Echo speakers represent the company’s initial foray into the voice-powered computing market, and 101data found that it already owns about 45% of that segment among the top 10 brands in terms of dollars sold. The Echo speaker is also the most popular speaker of its type sold online (albeit there isn’t too much competition, as the space is very new). Echo sales have surged 67% from last year, and it’ll be interesting to see how those figures hold up in coming quarters, given Google’s new competitor product, the Home speaker.

Perhaps most impressively, these market share and growth numbers are coming despite these private label products only being available to paid Amazon Prime subscribers.

Jed Alpert, Senior Vice President of Marketing at 1010data, commented that “Amazon is leveraging its dominance to sell their own private-label brands which compete with traditional suppliers.”

Continuing, “Reasons for Amazon’s success across different markets vary. In batteries, they have a price competitive product in a largely commoditized market with little brand loyalty. In speakers, they’ve developed truly innovative products that are redefining the market. The bottom line for brands is they can no longer view Amazon as solely a channel and need to acknowledge them as a competitor.”

Amazon is currently testing a slew of other private label brands and products as well, including groceries, diapers, clothes, coffee, cooking oil, snack foods, and many more.

Due to the size of its shopping platform, the company has the rare ability to test its own forays into multiple segments, and scale or cut them as needed. It’s also yet another way to leverage its Prime service, which is already far and away America’s #1 membership club.

Investors should expect the company’s strong sales growth to continue as a result.

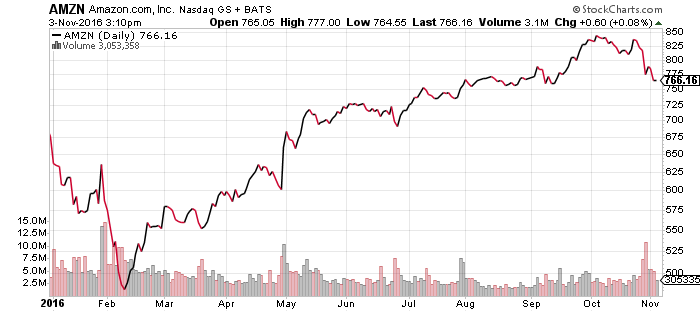

Amazon shares in Thursday afternoon trading. Year-to-date, AMZN has gained 13.38%, versus a 2.58% rise in the benchmark SPDR S&P 500 (NYSE:SPY) in the same period.