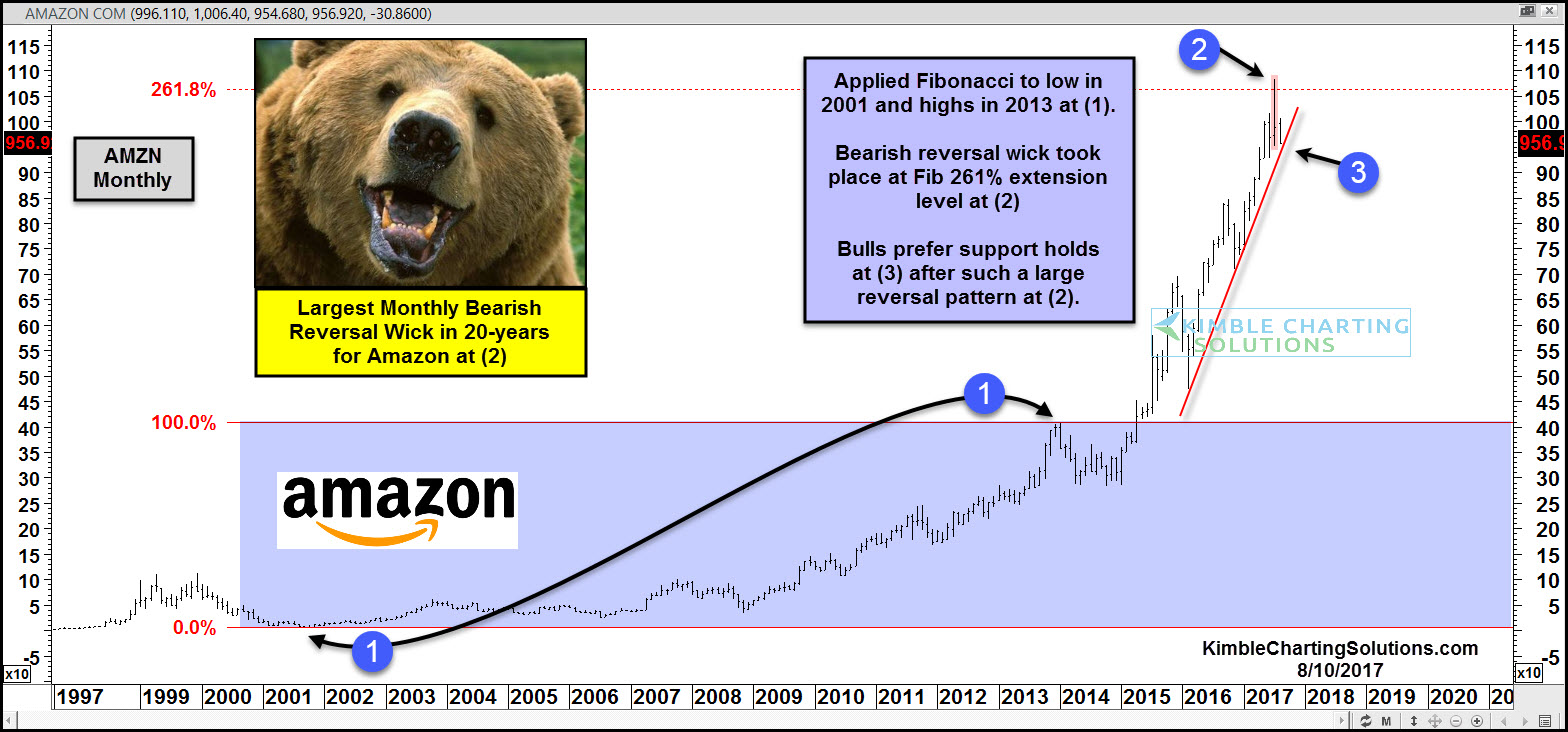

Amazon.com (NASDAQ:AMZN) has done well for years, now, and the trend remains up. But just last month, something happened to the stock that hasn't occurred in the past 20 years.

We applied Fibonacci to the lows in 2001 and highs in 2013 at each (1) and looked to see if any Fibonacci Extension level could come into play that might impact the stock. We found that the 261% Extension level came into play near the $1,007 level.

Big Bearish Reversal

Just last month, Amazon created its largest bearish reversal pattern since the highs back in 1999.

For sure, one month's action does NOT make a trend. When Amazon created a large bearish reversal back in 1999, it lost more than 50% of its value during the subsequent couple of years. The past month's huge bearish reversal pattern does not mean it will lose 50% again. Indeed, the company is a global leader and for some reason, last month's reversal pattern at the Fibonacci extension level could be an important clue as to the stock's future price in particular — and the broader market's outlook in general.

Amazon bulls want to see support hold at (3).