When: April 23 after market close

Expectations for Q1:

- Revenue $72.5 billion

- Revenue AWS $10.3 billion,

- EPS $6.35

What to watch: While the past few weeks have brought turmoil of unprecedented levels to many stocks, Amazon (NASDAQ:AMZN) is reaping notable gains as it emerges as the stay-at-home stock.

1. Online Retail Surges

Amazon appears relatively safe from the coronavirus hit thanks to its core business – online retail, which has picked up significantly amid the closure of brick and mortar outlets. Customers are ordering delivery en masse; the company is taking on an extra 175,000 staff to manage the rising demand. Expectations are the many people who started shopping online in the COVID-19 lockdown will continue to do so even after the lock down ends.

Furthermore, oil prices tumbling will have reduced shipping costs significantly.

2. Cloud and Streaming Services

The cloud business is benefiting from lockdown amid growing usage from existing and new customers plus AWS powers many leading apps such as Netflix (NASDAQ:NFLX), Disney+ and Apple (NASDAQ:AAPL). Streaming music and videos make it a major player in streaming wars, as streaming media becomes a popular past time for those forced to stay at home

3. Spending

However, Amazon’s spending is always worth keeping an eye on. Spending can outpace revenue even if sales are extremely strong. That said, we have seen in previous efforts such as building out fulfilment centres and cloud computing data centres and investment in Prime one day shipping, that Amazons willingness to spend can be beneficial.

Levels to watch

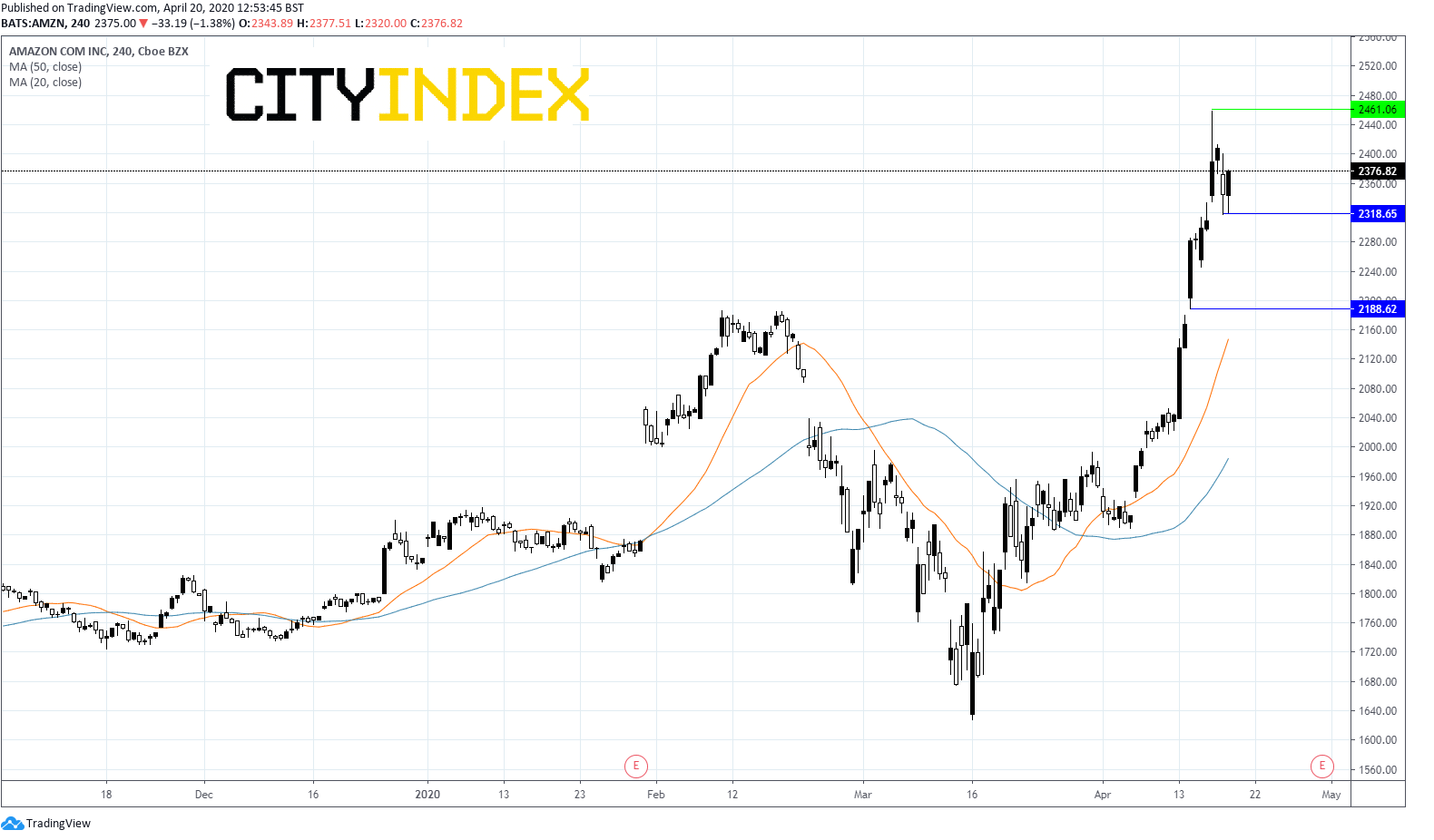

Amazon surged to a record high of $2,461 on hopes on hopes of a coronavirus related boom. The share price has just eased back slightly.

Amazon trades firmly above its 20 and 50 sma in a firmly bullish chart.

Immediate support can be seen at 2318 (low April 17) prior to 2188 (low April 14 and high Feb. 19).