From a span of a day to two hours, from two hours to fifteen minutes, and now from fifteen minutes to two minutes, Amazon.com, Inc. (NASDAQ:AMZN) is cutting down on its delivery time to Prime members.

The company on Tuesday launched the 'Instant Pickup' service for Prime and Prime Student members that will get ordered items ready in just two minutes.

Amazon Prime members are already enjoying free two-day and one-day deliveries. Additionally, there is Prime Now, a service that ensures that members get free two-hour delivery on select items. Also, Amazon Restaurants offers one-hour delivery for Prime members from popular restaurants. AmazonFresh grocery delivery service can fulfill orders within 15 minutes if users pay $15 per month.

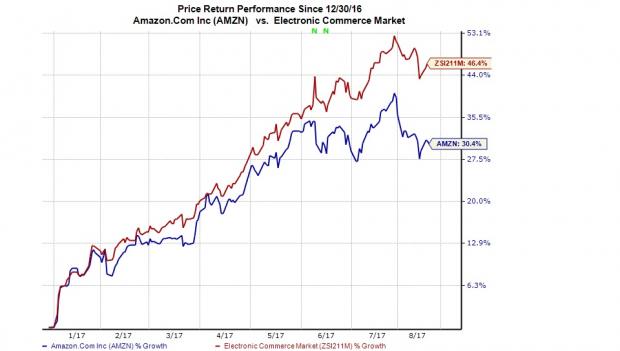

Shares of Amazon have gained 30.4% year to date, significantly underperforming the industry’s 46.4% rally.

About the Service

Shoppers can now order from a range of fast-selling items such as drinks, snacks and phone chargers using the Amazon mobile app. The company staff will place these in lockers at instant pickup points within two minutes. Shoppers can pick them up by accessing the locker with a bar code sent to them.

At launch, the service is available at five college campuses: University of California at Berkeley, Columbus, Atlanta, Ohio and College Park, Maryland. The company plans to expand this service to other places by the end of this year.

Amazon’s Three-fold Strategy

The move underscores Amazon latest efforts to counter slow growth in e-commerce and competition from the likes of Alibaba (NYSE:BABA) and eBay (NASDAQ:EBAY) . Since the company announced its acquisition of Whole Foods Market Inc. (NASDAQ:WFM) for a whopping $13.7 billion, there’s been a lot of speculation about reorganization options. That said, the new move makes sense as many items sold by Whole Foods are difficult to shift online.

Amazon.com, Inc. Net Income (TTM)

It has added online and offline features to its bookstores and is going the same way with innovations such as drive-in-grocery delivery service (AmazonFresh Pickup - order groceries online and collect them from a store nearby). The new move appears to be another innovation of this kind.

It also appears that Amazon is trying to tap the impulse buyer group with this move, a market that has largely been served by brick-and-mortar stores.

Lastly, Amazon continues pushing advantages to Prime members to boost sales, attract more customers and counter Prime saturation in the U.S. due to increased penetration rates.

A solid loyalty system in Prime has kept Amazon’s retail business unbeatable on price, choice and convenience. Prime memberships help in repeat sales of not just general merchandise but also media (books, music, video, etc).

Currently, Amazon has a Zacks #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Whole Foods Market, Inc. (WFM): Free Stock Analysis Report

Original post

Zacks Investment Research