Nike (NYSE:NKE) is set to release earnings after the market closes on Thursday, June 29. Both Estimize and the Street lowballed earnings estimates by roughly 20% in FQ3’17. It should be interesting to see if this trend continues, or if Estimize and the Street will be correct in their conservative predictions in FQ4’17.

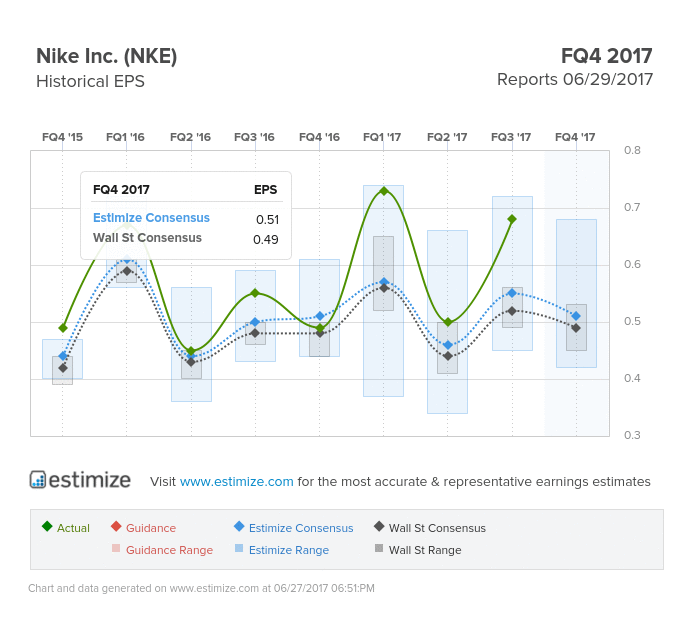

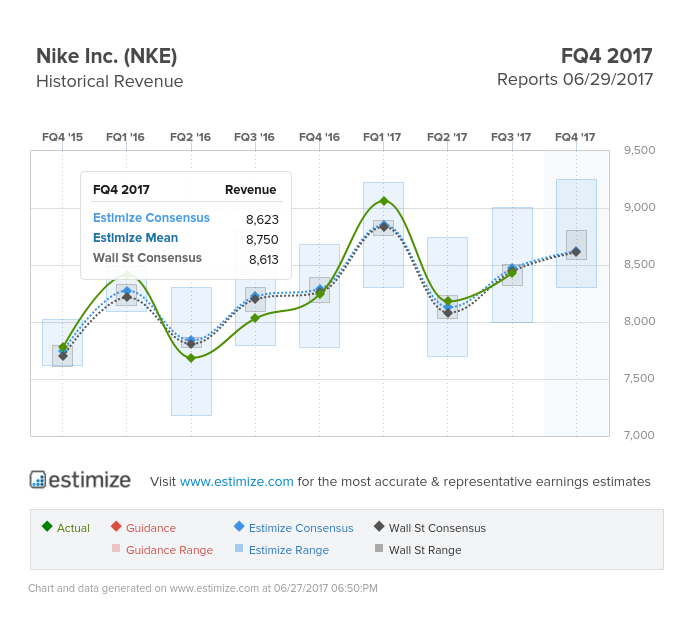

For this quarter, Estimize and Wall Street are coming in at roughly a similar number, with Estimize at $0.52 EPS and The Street at $0.49 EPS. Likewise, Wall Street and Estimize predict the revenue at a fairly similar value, with the Street coming in at $8,613M and Estimize at $8,633M.

Despite Nike being an undoubtedly popular brand, with athletic products ranging from shoes to clothes, their brand success is not necessarily represented in their stock’s success.

Ever since Amazon (NASDAQ:AMZN) made its way into the retail sector, stores like Macy’s (NYSE: M), JC Penney (NYSE: JCP) and Nordstrom (NYSE:NYSE:JWN) are feeling the effects, with their stocks facing a slight downturn. Likewise, Nike management recently announced a 2% decrease in global headcount; shares fell on the news.

Historically, Nike has only appeared on Amazon via third party vendors and on its sister site, Zappos. However, times are changing and Nike is now a vendor on Amazon.

This move is predicted to be a win-win for both corporations, as a recent Goldman Sachs (NYSE:GS) interview pointed to some problems that this partnership can fix. In the study, men claimed that Amazon was their go to e-commerce retailer for everything but shoes and athletic wear. Coincidentally, they ranked Nike as their number one for those two categories. Looks like Nike and Amazon can potentially see positive numbers in the near future.