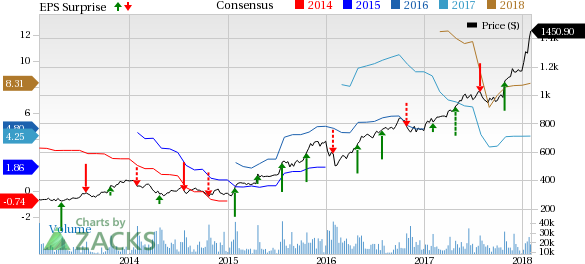

Amazon.com Inc. (NASDAQ:AMZN) just released its fourth quarter fiscal 2017 financial results, posting diluted earnings of $3.75 cents per share and revenues of $60.5 billion. Shares are up 2.64% in trading shortly after as a result.

Currently, AMZN is a Zacks Rank #3 (Hold), and for the most part, earnings estimates have been trending upwards over the last 60 days.

Amazon:

Beat earnings estimates. The e-commerce giant posted diluted earnings of $3.75 cents per share, which includes the approximate $789 million provisional tax benefit from the impact for the new tax reform bill. Excluding this tax provision, adjusted earnings for the quarter came to ~$2.19 per share. Net income was $1.9 billion.

Our Zacks Consensus Estimate of $1.85 does not take into account this benefit.

Beat revenue estimates. The company saw revenue figures of $60.5 billion, also beating our consensus estimate of $59.99 billion and increasing 38% year-over-year.

Operating income for the quarter surged 69% to $2.1 billion.

AWS revenues for Q4 came in to $5.11 billion.

For the first quarter of 2018, Amazon expects net sales in the range of $47.75 billion and $50.75 billion, representing growth between 34% and 42%. Operating income is expected to be between $300 million and $1 billion.

Amazon engages in the retail sale of consumer products and subscriptions in North America and internationally. It operates through the North America, International, and Amazon Web Services (AWS) segments. The company sells merchandise and content purchased for resale from vendors, as well as those offered by third-party sellers through retail websites. It also manufactures and sells electronic devices, including kindle e-readers, fire tablets, fire TVs, and echo; and provides Kindle Direct Publishing, an online service that allows independent authors and publishers to make their books available in the Kindle Store.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Original post

Zacks Investment Research