Amazon’s (NASDAQ:AMZN) strengthening cloud offerings continue to maintain its dominance in the cloud-computing space.

The company’s cloud arm Amazon Web Services (“AWS”) recently made a new feature of its scalable data warehouse Amazon Redshift, called Concurrency Scaling, available to customers.

Notably, the new feature enables fast query performance that aids AWS in providing virtual support to unlimited concurrent users and in regard to concurrent queries. Additionally, it aids Amazon Redshift in processing unpredictable concurrent read queries by adding extra cluster capacity automatically.

In this manner, Concurrency Scaling boosts the performance of Amazon Redshift by strengthening its scalability and flexibility.

Portfolio Strength: Key Catalyst

The company’s latest move bodes well for its continued efforts toward adding more features to Amazon Redshift.

Concurrency Scaling is likely to aid AWS in delivering a better experience to customers by helping them to manage their huge workloads. Customers using Amazon Redshift will be able to avail the robust processing capacity of the new feature at no additional cost.

Apart from the new feature, Amazon Redshift also features Elastic Resize that adds more nodes to a cluster in minutes. It’s another feature called Short Query Acceleration helps in solving interactive queries at a faster pace by leveraging Machine Learning (“ML”) techniques.

We believe Concurrency Scaling and the two above-mentioned features are expected to strengthen the number of data warehousing deployments done by Amazon Redshift in real-time and predictive analyses.

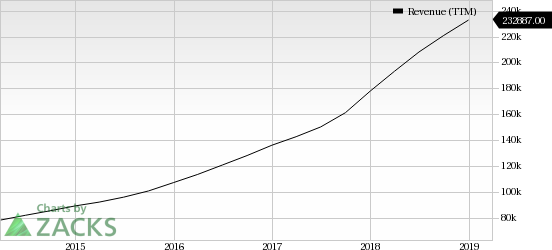

Consequently, this will help AWS gain further traction among customers, which is likely to drive its performance. This in turn will drive top-line growth of AWS.

Intensifying Cloud Competition

Cloud data warehouse software and solutions will continue to witness a robust demand in the near term as well as in the long haul, which can be primarily attributed to generation of vast structured and unstructured data across several industries.

AWS, with strengthening offerings of Amazon Redshift, is likely to deepen its penetration in the global data warehouse as a service market, which, per a report from MarketsandMarkets, is expected to hit $3.4 billion by 2023 at a CAGR of 23.8% between 2018 and 2023 from $1.2 billion in 2018.

However, the above-mentioned growth potential in the cloud data warehouse market is alluring enough to induce other cloud service providers such as Microsoft (NASDAQ:MSFT) , Alphabet’s (NASDAQ:GOOGL) Google, IBM (NYSE:IBM) , among others, to make advances for reaping benefits from the same, thereby intensifying competition.

Notably, Microsoft Azure offers Azure SQL Data Warehouse and Azure Databricks to create one hub for structured, unstructured and streaming data.

Further, Google Cloud’s BigQuery is a serverless and highly scalable data warehouse that leverages ML capabilities like Amazon Redshift.

Meanwhile, IBM Cloud’s data warehouse service named IBM Db2 Warehouse is fully managed and utilizes Artificial Intelligence (“AI”) techniques.

Nevertheless, growing momentum of Amazon Redshift owing to the flexibility that it offers to customers to extend data warehouse to Amazon S3 data lake without unnecessary data movement or duplication is likely to strengthen the company’s competitive position.

Currently, Amazon carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

International Business Machines Corporation (IBM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research