Amazon.com, Inc. (NASDAQ:AMZN) on Friday announced that it has reached a deal to acquire leading natural and organic foods supermarket, Whole Foods Market, Inc. (NASDAQ:WFM) for $13.7 billion. The all-cash transaction involves buying Whole Foods for $42 per share, at a roughly 27% premium to Whole Foods’ share price on Thursday.

The deal is expected to conclude in the second half of this year. However, Whole Foods will continue to operate with its current brand name and John Mackey will remain the CEO of the company. The deal gives Amazon an opportunity to leverage Whole Foods’ 460 stores across the U.S., U.K. and Canada, 87,000 employees and its solid reputation.

According to Cowen analyst John Blackledge, the acquisition will make Amazon the fifth largest U.S. grocery retailer after Wal-Mart (NYSE:WMT) , Kroger (NYSE:KR) , Costco (NASDAQ:COST) and Albertsons/Safeway.

Amazon.com, Inc. Net Income (TTM)

Amazon’s Blockbuster Move

The move is a clear indication that Amazon is thinking several years down the road.

Online retail sales are expected to decelerate while the overall retail market still holds a lot of potential. This might be due to the fact that a large number of customers still prefer to shop offline and will continue to do so in the future. This is particularly true when it comes to grocery. That being said, giants like Amazon have been making moves to gradually merge online and offline retail.

We believe that the acquisition will open up a window of opportunities for Amazon on this front. It will not only reshape the retail landscape but also help it counter competition, if it manages to get a first mover advantage.

Whole Foods’ Reorganization Options

Amazon has been testing waters with innovations such as drive-in-grocery delivery service (AmazonFresh Pickup - order groceries online and collect them from a store nearby) and “cashier-less” stores (Amazon Go – the company’s first brick-and mortar grocery store). It has also added online and offline features to its bookstores.

Amazon might add those features to Whole Foods’ stores in the future, and has simply started to mindshare in the grocery space. The acquisition gives Amazon opportunities to leverage on its resources and technological prowess to enhance shopping experience by cutting time and increasing convenience. This in turn could give it an edge over competing retailers.

Mackey Can Take it Easy For Now

Mackey has been facing investors’ ire because of his strategies that were thought to have resulted in Whole Foods’ poor performance. Activist investor Jana Partners and money manager Neuberger Berman have been criticizing the company and pressing on a merger with another grocer, which could have forced him to step down.

So, the merger with Amazon has saved Mackey’s face as well as position.

Rivals Take Note

Whole Foods has been struggling for some time mainly because of Mackey’s premium pricing policy. Rivals such as Wal-Mart, Costco, Kroger and Amazon have been denting Whole Foods’ sales by offering lower cost options.

But that may not happen anymore. Though it’s not yet clear whether Whole Foods will continue to operate with its current strategy but it is likely as Mackey will continue to operate as CEO. However, being under Amazon’s umbrella will ensure that it doesn’t lose out on sales.

Whole Foods could cater to the niche market that prefers to buy quality stuff at premium price, thus adding more to Amazon’s sales volume.

Amazon’s huge cash balance offers it flexibility to pursue growth in potential areas and various markets. So a few more acquisitions like this can change the retail landscape overnight and catch competitors off guard.

Notably, shares of dozens of supermarkets, food producers, shopping malls and payment processors collectively lost about $35 billion in the U.S. market on Friday in response to the news.

Acquisitions Make Sense

The new move comes on the heels of Amazon acquiring Dubai-based e-commerce giant, Souq.com. A closer look at these deals reflects that Amazon is pushing ahead with its e-commerce business outside the U.S. while putting more emphasis on the brick-and-mortar way in the U.S. (in the face of slow e-commerce growth and mounting competition).

So Amazon’s increasing transition from build to buy option is a clear indication that it wants to speed up its market penetration, expansion and competitive strategies.

Investors Likely to Reap Benefits

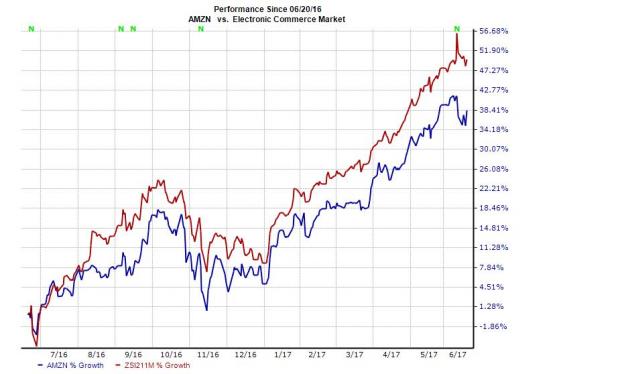

Over the last one year, Amazon’s share price has grown roughly 38%, thanks to its solid loyalty program in Prime, Fulfillment By Amazon, Amazon Web Services (AWS) and initiatives around Internet of Things (IoT).

Though brick-and-mortar initiatives are relatively new, investors will see far more growth if Amazon could repeat its past success in this space. Everything that Amazon touches has been transformed to gold and its brick-and-mortar venture could well add another feather in its cap.

Currently, Amazon has a Zacks Rank 3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Kroger Company (The) (KR): Free Stock Analysis Report

Whole Foods Market, Inc. (WFM): Free Stock Analysis Report

Original post

Zacks Investment Research