Revised guidance/forecasts

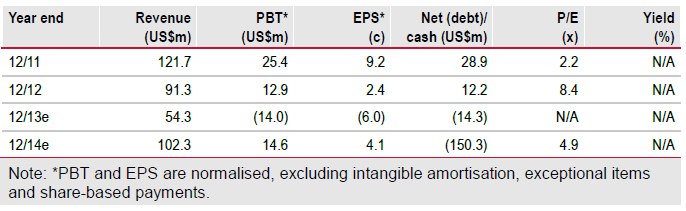

Production of 8,008oz of gold in Q3 was below Edison’s expectation of 9,794oz, principally, as a result of the decision to discontinue the processing of stockpiles of transitional material in the light of the lower gold price. As a result, Amara Mining Plc, (AMARA) has reduced its production guidance for the full year from 50,000oz to 40,000oz, while Edison has reduced its expectations from 45,471oz to 40,151oz. Of more significance however is output from material derived from the Sega licence, which achieved an annualised production rate of 56,000oz in November, supporting Amara’s official production guidance of 60-70koz in FY14.

Short-term catalysts: Yaoure and Baomahun

A formal mineral resource update at Yaoure is expected to be released by the end of the year. Current resources of 2.7Moz (at a 0.5g/t cut-off) are contained within 40% of the mineralised volume drilled. Assuming continuity of mineralisation etc, drilling out the remaining 60% presents the possibility of increasing the resource by 3-4Moz, although management is guiding towards a figure of 2-3Moz. In our note of 2 October, we estimated that this could eventually add as much as 6.9c (4.2p) to the valuation depending on the degree of resource increase at Yaoure (100% assumed) and the degree of upgrade (0.45Moz assumed upgraded from ‘inferred’ to ‘indicated’ although probably in FY15 rather than the forthcoming update). Following the Yaoure resource update, Amara expects to announce the results of the Baomahun re-optimisation in January.

Long term: Potential 205% upside

Subsequent to the updating of our gold price forecasts (see Gold – US$2070/oz by 2020, published in November 2013), Edison estimates a (diluted) value for Amara of US$0.62 (£0.38), based on estimated (maximum potential) dividends payable to shareholders over the life of operations. This valuation specifically excludes blue sky (eg exploration at Yaoure). At a long-term price of US$1,243/oz, by contrast, the equivalent valuation falls to US$0.13 (£0.08) per share – implying that the market is beginning to discount either a higher gold price in Amara’s valuation or the execution of future value-adding initiatives by management. In the meantime, Amara’s post-transaction EV of US$59.0m compares to a global average cost of discovery of its resource base of 5.7Moz (attributable) of US$56.1m, ie it would cost effectively as much for a major to purchase Amara and its associated production, assets and resources as it would to invest in exploration to discover the same resource base (without the associated risk).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Amara Mining: Potential 205% Upside

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.