Investing.com’s stocks of the week

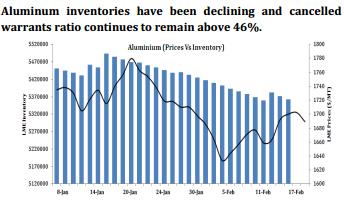

--Aluminum has been the top performer among the entire base metals pack with a gain of 5% over the last three weeks aided by higher equities and a weak dollar.

--We expect the aluminum prices to continue to trade higher in the short term on news that major aluminum producers are cutting down their production capacities. According to the secondary sources Alcoa will close its plant at Australia and Rusal estimated that producers outside China might have reduced their production by 1.2 million tons and estimates further production cuts in the range of 1-1.5 million tons in the present year.

--During the day Aluminum might face some negative pressure due to the negative equities globally along with the negative Chinese manufacturing data released by HSBC declined to 48.3 from 49.5. However broadly we expect aluminum to trade marginally higher taking positive cues from the production cuts in spite of the weak Chinese manufacturing data and housing starts data from the US overnight.