This article was written exclusively for Investing.com

- Multi-year highs in aluminum

- Inventories trend lower; Production costs increase

- Chinese sales have not stopped the rally

- Alcoa: worldwide producer with a bullish earnings trend

- Levels to watch in AA shares

Copper may have the highest profile of the base metals that trade on the London Metal’s Exchange, but aluminum is the most liquid. Aluminum forwards trade most actively on the world’s leading base metals exchange, with the greatest number of tons changing hands each day. Aluminum is a highly liquid market as the metal has many industrial applications.

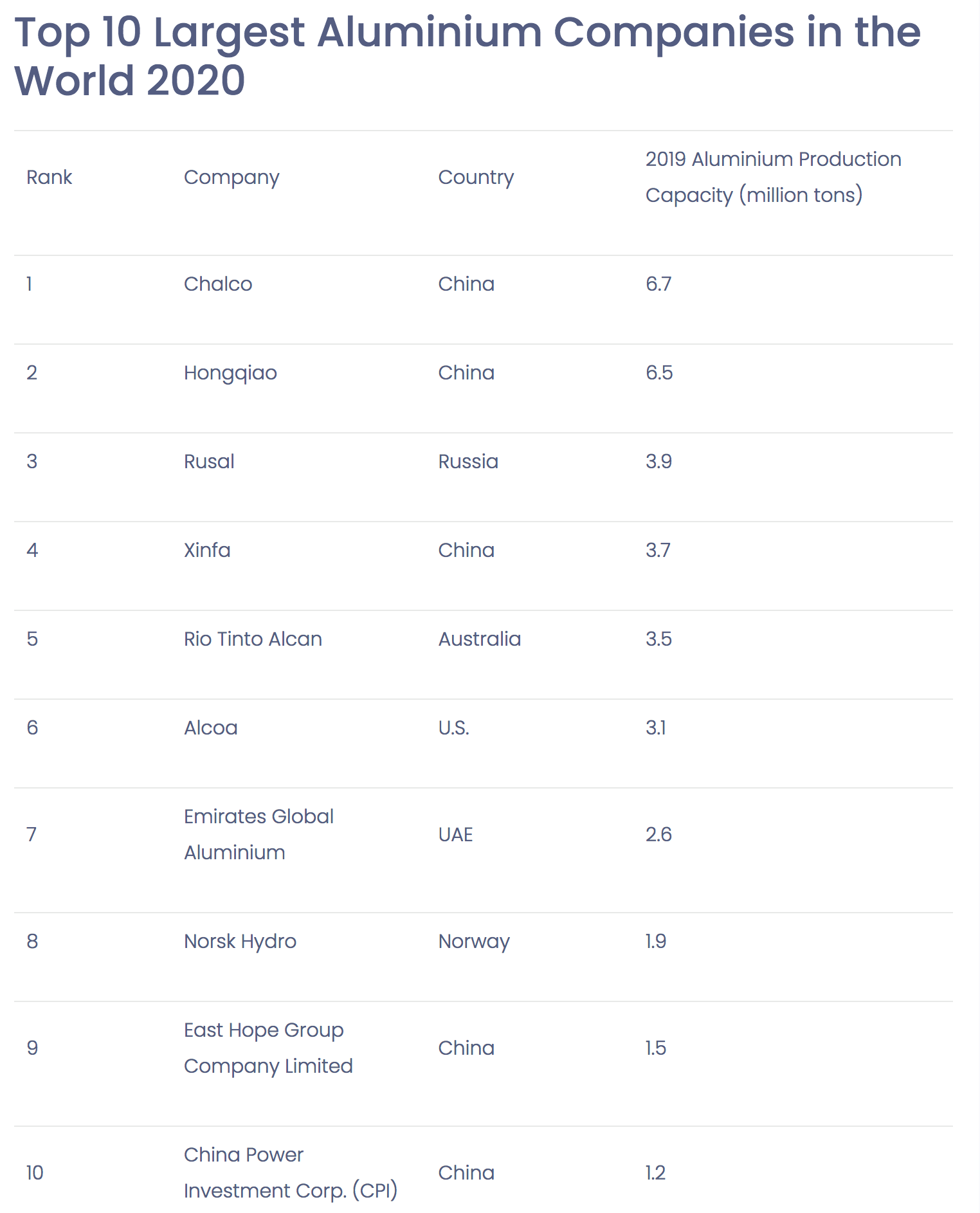

One of the direct cost of goods sold inputs in producing aluminum is energy. Moreover, mining, smelting, refining, and processing aluminum has been a dirty business, leaving a substantial carbon footprint. In 2020, China was the world’s leading aluminum producer:

Source:Bizvibe

The US is ninth in global production, but Pittsburgh, Pennsylvania-based Alcoa (NYSE:AA) is the sixth-leading aluminum producing company:

Source: Bizvibe

The price of aluminum has exploded to multi-year highs, and Alcoa shares have gone along for the bullish ride.

Multi-year highs in aluminum

At the height of the risk-off selling at the start of the global pandemic, all asset prices dropped, and aluminum was no exception. Aluminum is a nonferrous metal that is an essential infrastructure building block. The base metal is also a requirement in the quest to address climate change as it is a component of many clean energy initiatives. Ironically, producing aluminum requires an electrolytic process that uses lots of power.

The price of the metal has soared since reaching a low of $1455 per ton on the three-month LME forward contract in April 2020.

Source: Barchart

The chart shows that aluminum forwards climbed to the highest price since July 2008 this month when it traded at $3,229 per ton, over double the price at the April 2020 low.

Three-month futures reached their peak on Oct. 18 and pulled back to the $2,868 per ton level as of Friday, Oct. 22.

Inventories trend lower; production costs increase

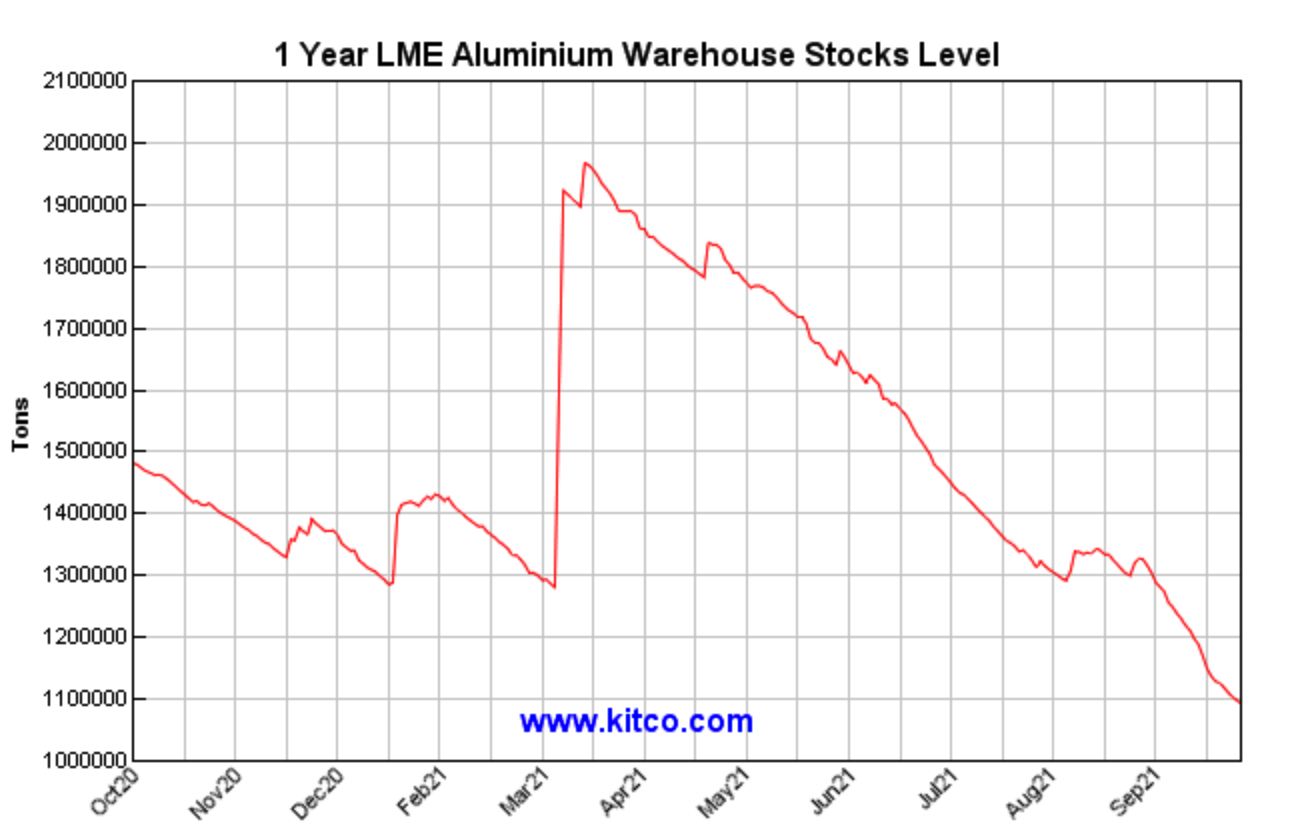

Aluminum inventories on LME warehouses have been trending over the past months.

Source: LME/Kitco

The chart shows that aluminum in LME warehouses worldwide dropped from the 1.95 million ton level to 1,086,625 tons as of Oct. 22, a 44.3% decline.

The declining inventory levels are a sign of robust worldwide aluminum demand.

Ironically, aluminum is a core metal for the transition to renewable energy sources. Aluminum production requires intensive use of electricity generated by crude oil, natural gas, and coal. Rising traditional energy prices are putting additional upside pressure on the base metal’s price.

Chinese sales have not stopped the rally

Over the past months, China has sold base metals and crude oil from strategic stockpiles to cool the price appreciation. From July 2021 through October 2021, the Chinese government has sold 570,000 metric tons of copper, aluminum, and zinc. In early October, China held its fourth auction that included 70,000 tons of aluminum. The sales did not prevent aluminum forwards from reaching a new high at $3,229 per ton this month.

Meanwhile, China is now selling coal at reduced prices to aluminum and other commodity producers, pushing the price lower from the new all-time high for the dirtiest fossil fuel.

Alcoa: worldwide producer with a bullish earnings trend

The price action in Alcoa shares, as well as its earnings reflect aluminum’s price rise from the 2020 low to the October 2021 multi-year high. Producers offer leveraged exposure to the commodity they extract from the earth’s crust and process into industrial raw materials. The shares tend to outperform during rallies in the underlying commodity and underperform when prices drop. Producing aluminum is a capital-intensive business. Mining, smelting, and refining involve high costs, but the payoff can be enormous.

Source: Barchart

The chart highlights AA’s rise from $5.16 per share in late March 2020 to the most recent high of $57.57 on Oct. 18. While the LME aluminum price rose by 122%, AA shares moved over 11 times higher. At the $51.17 level on Oct. 25, AA pulled back from the recent high, but remained nearly ten times higher than the 2020 low.

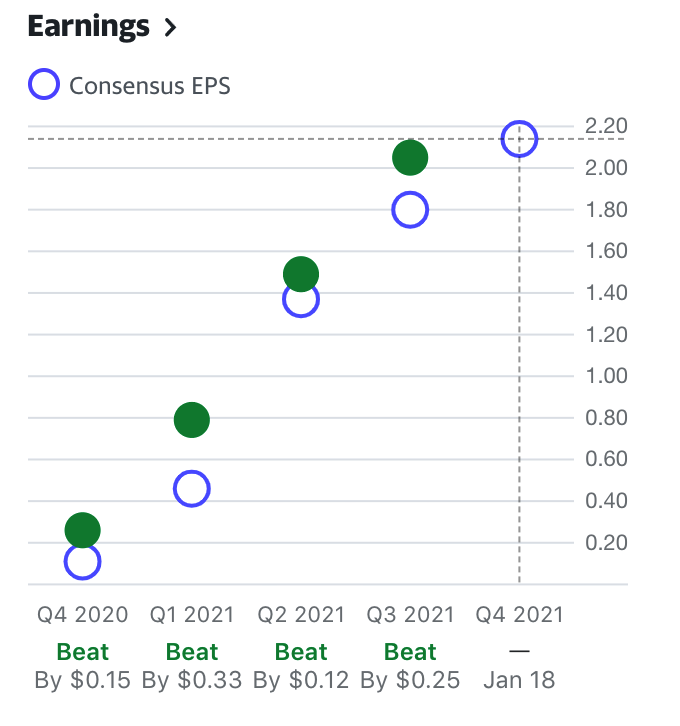

Source: Yahoo Finance

The chart above shows the bullish trend in AA earnings. The company reported strong third-quarter fiscal earnings on Oct. 14, beating expectations. It also announced it was initiating a dividend and stock buyback program to bolster shares.

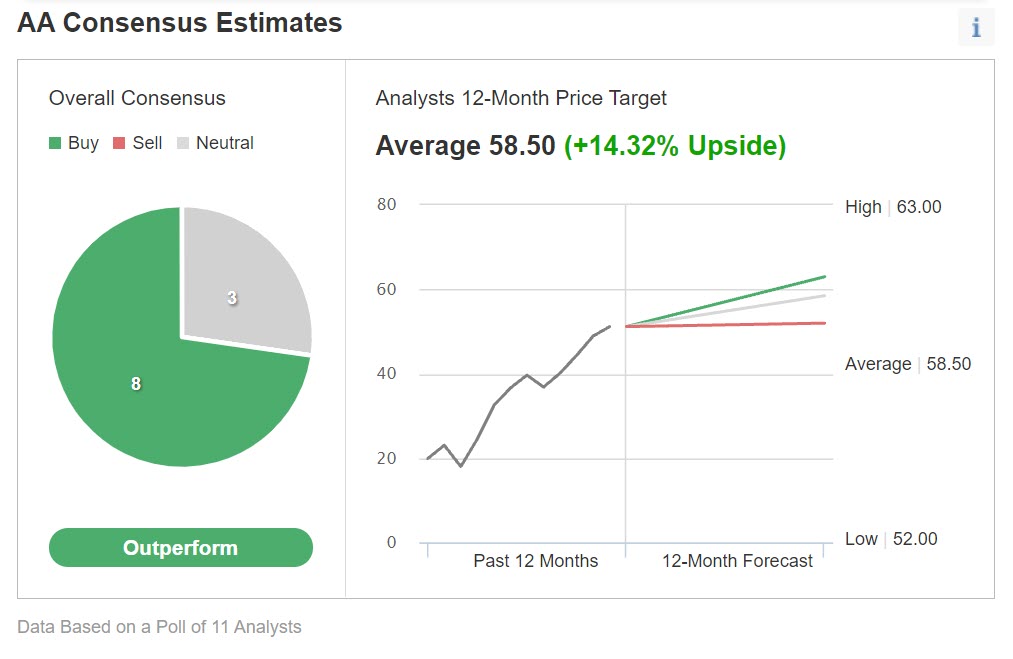

Aluminum’s rise to the highest level since 2008 is a sign the company is on track to continue accelerating its growth. A survey of 11 analysts on Investing.com has a $58.50 target for AA shares, a 14.32% upside, with forecasts ranging from $52.00 to $63 per share.

Chart: Investing.com

AA pays shareholders an annual $0.40 dividend, translating to a 0.81% yield at the current share price.

Levels to watch in AA shares

Rising global inflation, increasing aluminum demand, and the metal’s price trend support higher prices for AA shares.

Source: Barchart

Above the recent $57.57 peak, the technical target for the stock stands at the April 2018 $62.35 high. The all-time peak occurred in July 2007 at $109.22 per share.

Alcoa shares have room to continue rallying as the path of least resistance for the stock remains high in late October 2021.