Investing.com’s stocks of the week

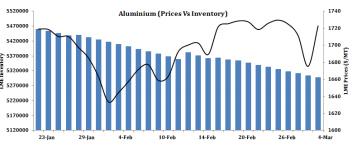

Aluminum's 3-month forward prices at the LME recovered sharply yesterday by $50 and settled at $1770. We believe that there has been no major change in the fundamentals overnight, just a mere recovery that took place in the entire complex after concerns over Russian action against Ukraine settled down. We would not like to change our bearish stance on Aluminum due to the fact that cash prices across the globe, especially in China are trading lower, which could eventually pull the price down in the near-term. Nonetheless, the LME inventory showed a good amount of fall by 6,800 while the cancelled warrants ratio remained in the negative. We would also like to reiterate that the underlying fundamentals do not change on a daily basis but that it is the market dynamics that play an important role.

This morning in Asia, the 3-month Aluminum forwards are seen trading at $1770, unchanged from the previous close. We believe that prices may initially show a good recovery as the euphoria for risky assets growing may continue. However, we believe that any rise in prices should be a good sell signal for the commodity. Also, the P-V-OI suggests that the bullish effect noticed yesterday is not supported with a good trend, which indirectly means that aluminum prices may again turn lower. Finally, we recommend selling from the higher levels for the day.