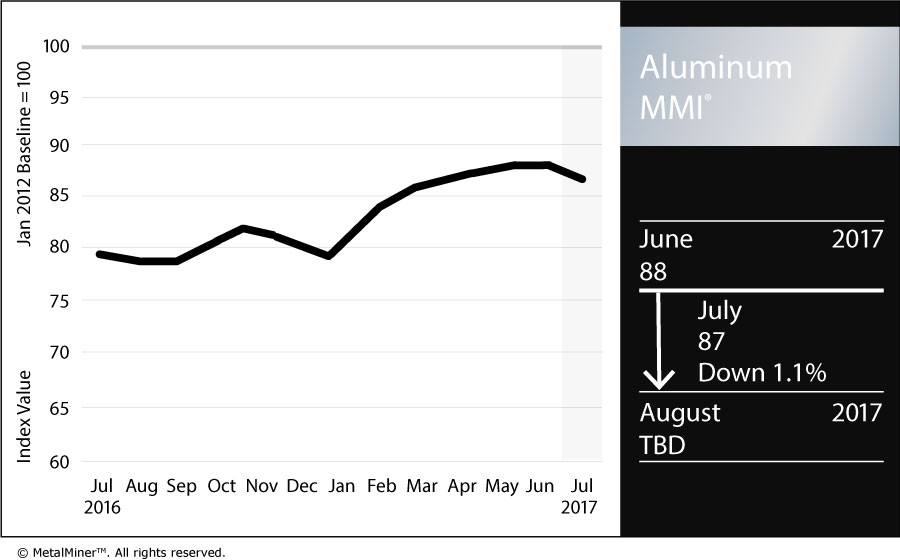

The Aluminum MMI dropped one point for our July reading, falling back to 87 after May and June saw the sub-index check in at 88.

The sub-index has been in somewhat of a holding pattern since April, when President Donald Trump’s investigation announced it was opening investigations into steel and aluminum imports, invoking the little-used Section 232 of the Trade Expansion Act.

The Commerce Department held a public hearing June 22, during which industry executives offered their opinions on the challenges facing U.S. aluminum and whether protectionist actions should be taken. While primary manufacturers welcomed tariffs or quotas, downstream manufacturers weren’t as keen on the idea.

More recently, the International Trade Commission (ITC) released its own report on the competitive conditions affecting the U.S. aluminum industry. The report’s executive summary zeroed in on five factors: the global aluminum industry is widely affected by government intervention through policies and programs that principally impact primary aluminum production costs; the chief determinants of competitiveness vary among industry segments; as of 2015, China was the world’s largest aluminum producer and consumer; competitiveness of the U.S. industry varied across segments; and the global aluminum market experienced price declines of roughly 30% during 2011–15 due to oversupply.

U.S. imports rose by 41% during the period from 2011–2016, to nearly 1.7 million metric tons, according to the ITC report. In terms of wrought aluminum imports, in 2016 the U.S. took in the most product from China (531,000 metric tons), with Canada coming in second (452,000 mt).

There was an uptick in optimism from the metals industry after the election of President Donald Trump, given his campaign promises regarding infrastructure building projects. Those campaign promises have yet to gain traction, and that initial excitement has leveled out, in short, many are in wait-and-see mode.

Per Section 232, the Commerce Secretary has 270 days to present the president with a report and recommendations. Many expect those investigation results to be announced sometime this month, although no official word has been given.

In an emailed statement Friday, Heidi Brock, president and CEO of The Aluminum Association, wrote:

Regarding the Section 232 investigation on aluminum imports and national security, we continue to engage the Administration and Capitol Hill to promote our three principles of 1) focus on the problem of Chinese subsidized aluminum overcapacity, 2) exempt Canadian imports and other foreign producers such as the European Union who trade fairly and have not contributed to rising global overcapacity, and 3) consider the effects of overcapacity on both primary and downstream producers.

by Fouad Egbaria