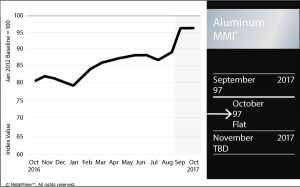

The Aluminum MMI remained flat this month, holding at 97 for our October reading.

After skyrocketing in August, aluminum prices took a breather in September, as attention turned to other base metals, like zinc.

Source: MetalMiner analysis of FastMarkets

Aluminum traded sideways in September. This trading pattern suggests resilience, as aluminum prices digest price gains and become strong again to continue the uptrend. Trading volumes continue to support the current rally, driving aluminum prices to a five-year-high in September.

The rally has also taken place on the Shanghai Futures Exchange (SHFE), which follows the same trends as the LME. Late last month, aluminum prices reached a six-year-high on the SHFE.

However, aluminum recovered strength during the first week of October. Aluminum prices — and other base metals, like copper and zinc — posted gains during the first week of October. Aluminum prices could break a new resistance level again. Trading volumes remain heavy, which means that aluminum strength may continue this month.

From a domestic market perspective, the natural disasters of Hurricanes Harvey and Irma supported aluminum prices. Aluminum demand will receive a boost in the mid-term, as automotive production will likely not slow down as previously predicted.

Even if automotive production does not increase, automotive material substitution will prevent aluminum production from dropping. Aluminum demand will likely also receive a lift in demand from screen, window and patio enclosures damaged by the storm.

Indian Aluminum Market Trends Up

When talking about aluminum, most analysts, including this publication, talk about China, which remains the 800-pound aluminum gorilla.

According to the International Aluminum Institute (IAI), China accounted for up to 53.3% of aluminum production in August. U.S. and Asia ex-China (where India is included) each account for 6.8% of primary aluminum production. Even though that number appears drastically lower than China’s, it still represents a nice slice of the proverbial pie. Therefore, metal-buying organizations will want to pay attention to India.

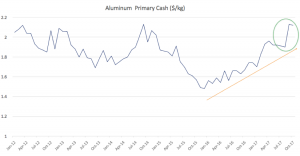

The Indian primary aluminum cash price has been in an uptrend since the beginning of 2016. When comparing this chart with the LME aluminum (see chart above), Indian prices rallied twice, in January and August of this year.

Although Indian prices decreased slightly in September, a strong uptrend continues for the Indian aluminum market.

As our own Sohrab Darabshaw reported last week, “A recent report by professional services agency KPMG has said demand for non-ferrous metals, including aluminum and copper was likely to grow around 8% over the next five years.”

Therefore, it makes sense for buying organizations to monitor the Indian aluminum market.

What This Means for Industrial Buyers

As aluminum remains in a bullish market, adapting the right buying strategy becomes crucial to risk reduction and knowing when to buy.

A deeper analysis of aluminum markets will be released this week via our free Annual Metals Outlook Report.

by Irene Martinez Canorea