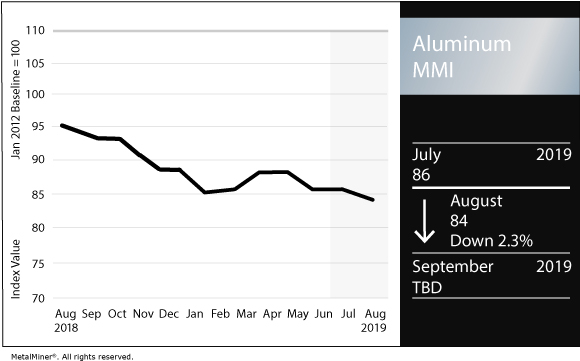

The Aluminum Monthly Metals Index (MMI) dropped two points this month to 84. Most of the prices tracked for the index dropped this month, with European prices dropping the most (by close to 7.5%).

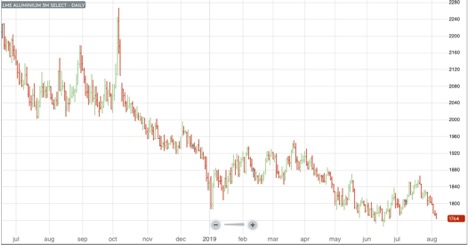

LME aluminum prices fared best of all of the aluminum prices this month, posting a mild increase of less than 1%. Aluminum prices continued to move sideways in July, generally trading above $1,800/mt.

However, the price ended July weaker, then dropped — along with most industrial metals — following the U.S. announcement of $300 million in new tariffs on China (effective Sept. 1).

Source: MetalMiner analysis of London Metal Exchange (LME) and FastMarkets

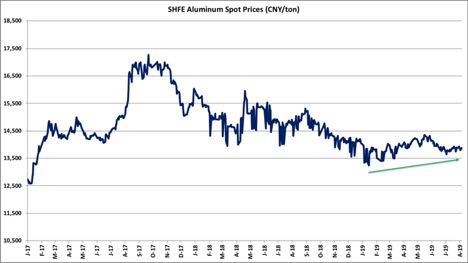

SHFE aluminum prices moved sideways recently, but with some upward momentum evident and higher lows throughout the year.

China produced 2.97 million tons of aluminum in June, down slightly from May’s production of 2.98 million tons. However, the June total was still up year on year by 1.3% up over May on a daily average basis, according to Reuters calculations. In May, production averaged 96,000 tons per day, and rose to 99,000 tons per day in June.

China’s higher daily production levels followed a jump in prices during May to around CNY 14,350/mt, which helped turned margins positive again for some smelters and fueled a production ramp-up.

China’s Zhongwang Holdings (HK:1333) and its controlling shareholder, Liu Zhongtian, were recently charged with evading $1.8 billion in tariffs on aluminum imports. The company allegedly disguised the aluminum as pallets in order to evade the duties on U.S. imports from China.

Novelis Announces New High-Strength Automotive Aluminum Product

Novelis recently announced a new high-strength aluminum product for next-generation automotive body sheet design called AdvanzTM 6HS-s650.

According to the company, the advanced aluminum offers improved strength, lightweighting capabilities, formability, performance and structural integrity. The company estimates a 15-25% improvement over existing high-strength aluminum alloys. Compared with steel in similar applications, the end-weight outcome can be improved by 45%.

Novelis’ acquisition of Aleris faced new hurdles this month. European Union competition authorities required Novelis to offer concessions by Aug. 9. to gain approval for the $2.6 billion takeover.

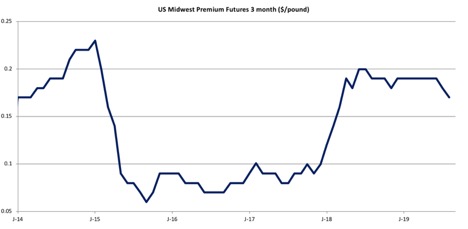

U.S. Aluminum Premiums

The U.S. Midwest Premium dropped once again, but only slightly, to $0.17/lb. Softer demand in the U.S. still fails to offset supply tightness in the market, keeping premiums higher.

What This Means For Industrial Buyers

Demand weakness in most markets impacted the index this month. While macroeconomic uncertainty due to the latest trade situation recently impacted some prices, in the case of the weakening index, this came from a genuine downturn in demand.

Actual Metal Prices And Trends

This month European prices decreased after increasing by around 2% last month. European commercial 1050 sheet and 5083 plate both dropped by 7.4% to $2,364/mt and $2,788/mt, respectively.

Korean prices also reversed and decreased this month after increasing in the 2% range in June. Korean commercial 1050 sheet, 5052 coil premium over 1050, and 3003 coil premium over 1050 all decreased in the range of 3-4% to $2.98, $3.15 and $3.02 per kilogram, respectively.

India’s primary cash price dropped by 2.9% to $2.03 per kilogram.

Chinese price movements were mixed and mild, holding essentially flat.

The LME aluminum price gained the most, rising 0.8% to $1,807/mt.

by Belinda Fuller