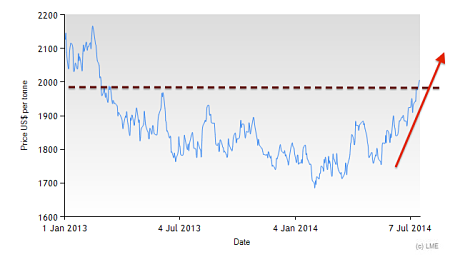

The three-month LME aluminum price finally traded above $2,000/ton on Monday, hitting our target point. The move doesn’t come as a surprise to us. In June, we pointed out that the stock of aluminum-related companies, such as Alcoa, was skyrocketing due to high expectations on the future use of aluminum in automobile and aerospace sectors. Watching aluminum-related stocks rising while aluminum prices remained low was an uncommon divergence that we expected to converge at some point.

Since we pointed this out in June, Alcoa’s stock price has surged 20% and today it is at a three-year high. Meanwhile, aluminum prices followed up, reaching a 17-month high. The move looks very bullish and it seems that aluminum has plenty of room to go higher.

The move is not only supported by aluminum-related stocks. Industrial Metals also had a good half. Indonesia’s export ban and the closure of major zinc mines pushed nickel and zinc prices higher so far this year. Aluminum is finally catching up with them and copper remains the laggard, but even it is showing some signs of life. Since industrial metals have historically moved in tandem, this grouped trend favors the continuation of aluminum on its way up with aluminum-related companies such as Alcoa.

What This Means For Metal Buyers

It looks like the aluminum bear market that started in 2011 has come to an end. Aluminum reached our price target on Monday. We would suggest aluminum buyers be hedged as we would expect aluminum prices to trend upwards throughout the rest of the year.

by Raul de Frutos