Investing.com’s stocks of the week

Aluminum ended the yesterday's trading session marginally lower by 0.06% at the LME platform as the commodity continues to take positive cues from the short term supply tightness.

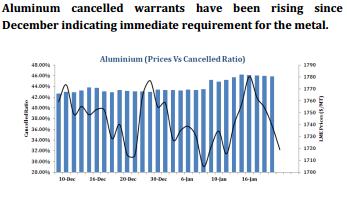

Aluminum stocks declined by 39,875 MT and the cancelled warrants for the commodity increased from 2345275 MT to 2502800 MT. However this positivity on the inventory front and short term supply squeeze in the commodity due to lack of availability of the metal due to abnormally low temperatures in the US did not protect the metal from a sharp fall during the week.

For the day, we have a sell view on Aluminum as the commodity might take negative cues from the new home sales data in the evening session which is expected to decline and may have a slightly negative impact on all metals, including aluminum. For the week, we hold a buy view on aluminum from the lower levels as aluminum premiums surged to 20 cents per pound from 17 cents per pound due to the lack of availability of the metal due to abnormally low temperatures in the US and longer wait times to take the metal out from the warehouses, along with the closing of smelters, with the capacity cuts totaling approximately 835,000 MT, mainly in America.